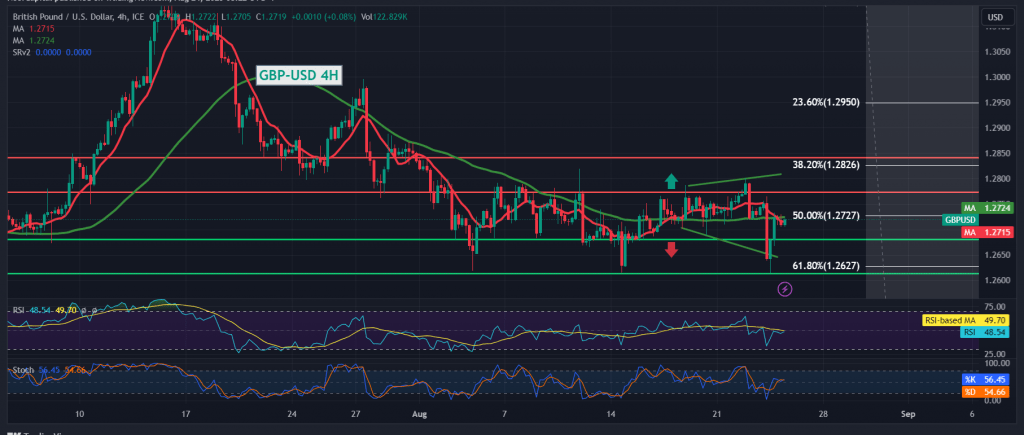

The British pound fell against the US dollar during the middle of the previous trading session to reverse the expected bullish trend after it succeeded in breaking the 1.2720 support, explaining that this leads the pair directly to visit 1.2630, recording its lowest price at 1.2615.

On the technical side, the pair returned to achieve a bullish retracement after approaching the support of the psychological barrier 1.2600, which forced it to retest the resistance level of 1.2760, the pair is now hovering around 1.2720 50.0% Fibonacci correction, which constitutes a resistance level around the 50-day simple moving average, in addition to the beginning of signs of weakness on the stochastic indicator.

We prefer observing the price behavior of the pair from below, around 1.2675, and breaking it would put the price under strong negative pressure, targeting 1.2630, and the losses may extend towards 1.2550 while breaching 1.2770 could be a catalyst for consolidating gains towards 1.2800 & 1.2850.

Note: Today we are awaiting economic data from the summit of the “BRICS”, and “Jackson Hole Economic Forum”, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations