Mixed trading dominated the movements of the British Pound against the US dollar during the last trading session, affected by the continuous rising British inflation, to continue a movement within the expected bullish path, touching the first target of 1.2310.

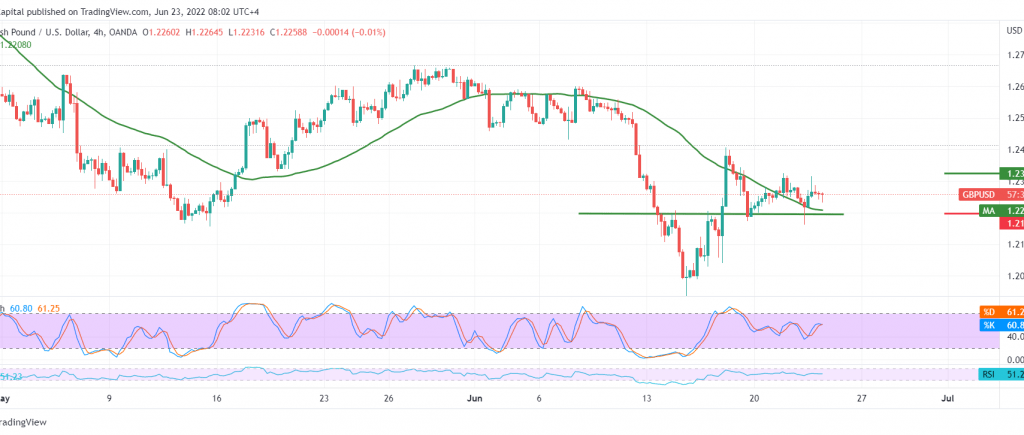

Technically, by looking at the 4-hour chart, the pair is still stable above the 50-day simple moving average, which is trying to hold the price from below and meet near the strong support level of 1.2200 and add more strength to it, in addition to the attempts of stochastic to get rid of the current negativity.

We tend to be positive, but on the condition of stability above 1.2200 and consolidation above 1.2275, to facilitate the task required to visit 1.2325, considering that rising above 1.2325 increases and accelerates the strength of the bullish bias, so we are waiting for 1.2395.

The breach below 1.2200 constitutes a negative pressure factor on the Pound, and we may witness a touch of 1.2175 and 1.2110.

Note: The testimony of “Jerome Powell” Chairman of the Federal Reserve is due today, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations