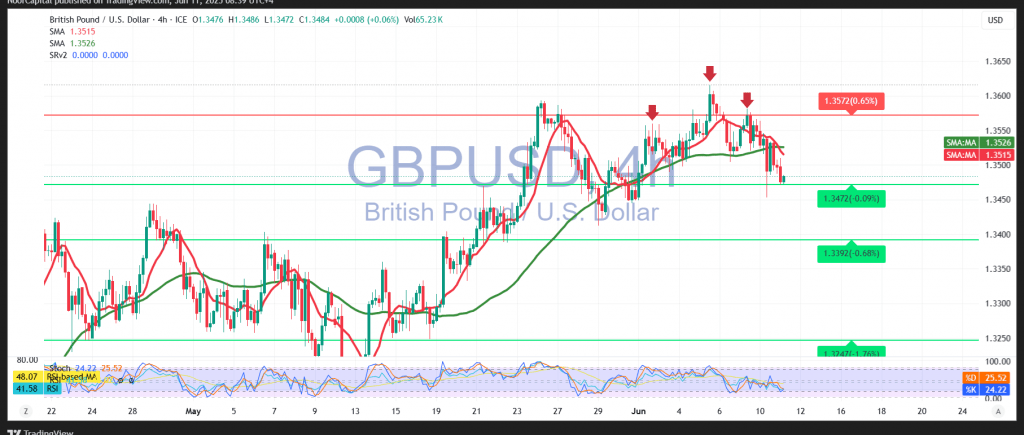

The British pound declined against the U.S. dollar during yesterday’s session, pressured by the 1.3560 resistance level, which acted as a cap and triggered a wave of negative trading. The pair recorded an intraday low near the key 1.3460 support level.

From a technical perspective, the 4-hour chart reveals a bearish price structure, with increasing negative momentum. Price action remains firmly capped below the psychological resistance at 1.3500, and we are seeing confirmation from a bearish crossover of the simple moving averages, reinforcing downside pressure.

As long as the pair remains below 1.3500 and especially if a clear break below 1.3460 is confirmed, the bearish scenario remains active, targeting 1.3440 followed by 1.3390 as the next key support levels.

However, should the pair hold above 1.3460 and successfully break through 1.3500, a short-term recovery may occur, with 1.3545 becoming the first upside target.

Market Risk Warning:

Today’s release of the U.S. Core CPI (monthly and annual) represents a high-impact economic event that could trigger significant volatility in the GBP/USD pair, especially given the implications for future Fed policy.

Caution: With elevated geopolitical and macroeconomic uncertainty, traders should prepare for sharp price movements in either direction. Risk management is essential.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations