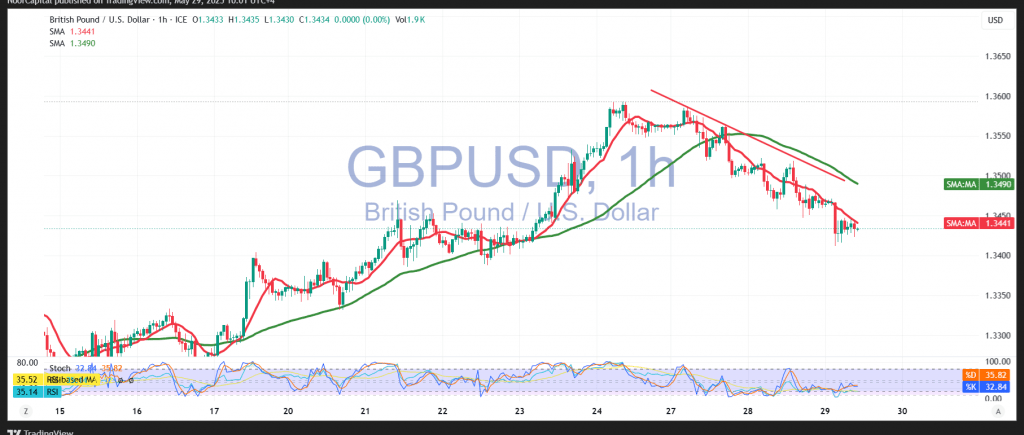

For the second consecutive session, the British pound has failed to achieve a daily close above the psychological resistance level of 1.3500, resulting in renewed negative momentum and a shift toward a short-term bearish bias.

From a technical perspective, the 4-hour chart shows the pound beginning to pressure the 1.3410 support level, as the simple moving averages weaken and lose their supportive momentum. This setup reinforces the potential for continued downside pressure in the near term.

As long as daily trading remains below the key 1.3500 resistance level, the bearish bias is favored. The immediate downside target is 1.3390, with a break below this level likely to accelerate the downtrend and open the way for a move toward 1.3350.

Traders should exercise caution ahead of the release of high-impact U.S. economic data, including Preliminary GDP (Quarterly) and Weekly Unemployment Claims. These reports could generate significant volatility in the GBP/USD pair.

Risk remains high amid ongoing trade tensions and broader market uncertainty. All scenarios are possible, and traders should manage their positions accordingly.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations