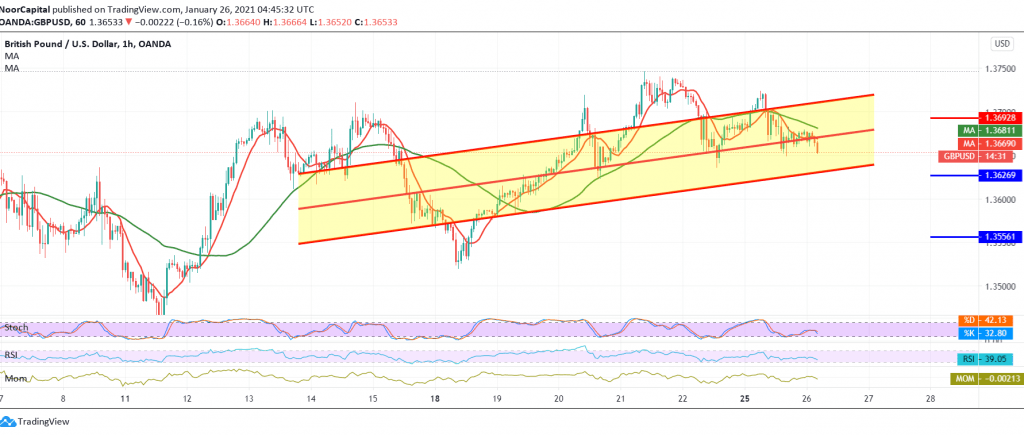

The British pound started its daily trading with a bearish tendency after it failed to settle for a long time above the psychological barrier of 1.3700, to start today’s session by pressing on the support level of 1.3650.

On the technical side, we are biased towards the negativity dependent on the RSI gaining bearish momentum, in addition to the clear negative crossover signals on Stochastic.

Therefore, the bearish bias is likely today, targeting 1.3625 and then 1.3600, respectively, knowing that the confirmation of a breach of 1.3600 increases the negative pressure, so that the way is directly open towards 1.3550.

Only from the top, the crossing to the upside and rising again above 1.3700 will immediately stop the attempts to decline and the pair will recover again with targets starting at 1.3750 and may extend to 1.3775.

| S1: 1.3650 | R1: 1.3755 |

| S2: 1.3595 | R2: 1.3795 |

| S3: 1.3550 | R3: 1.3850 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations