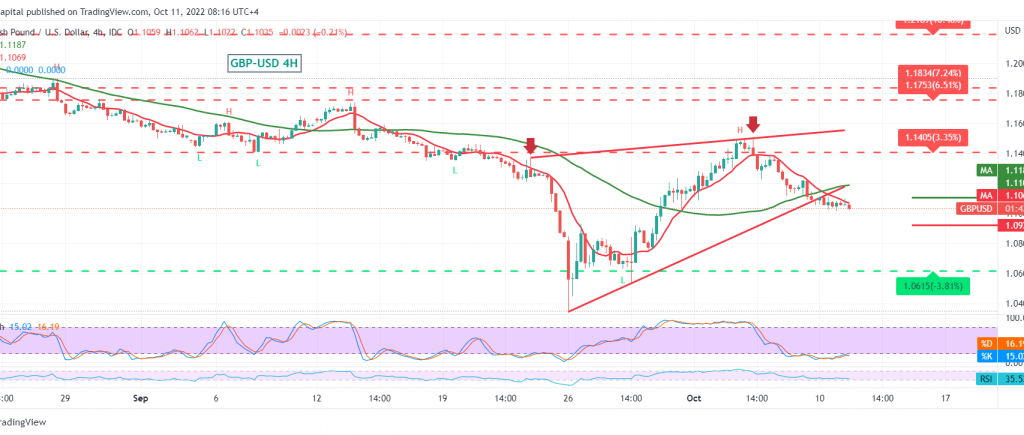

The British pound moved away from its recent temporary gains against the US dollar to witness the current movements of the pair stabilizing below the psychological barrier of 1.1100.

Technically, with the continuation of the negative pressure of the simple moving averages, in addition to the clear negative signs on the RSI and its stability below the 50 mid-line.

Therefore, the bearish bias is the most likely today. Still, we prefer to confirm the breach of the 1.1000 low, which increases and accelerates the strength of the daily bearish trend, so we are waiting for the 1.0965 first target, and then 1.0915 awaited next station.

Activating the suggested scenario depends on the price stability below 1.1100 resistance, and consolidation above it may stop the daily bearish trend. We witness an attempt to recover with targets 1.1145 and 1.1170.

Note: Markets are awaiting the BOE Governor’s speech and may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations