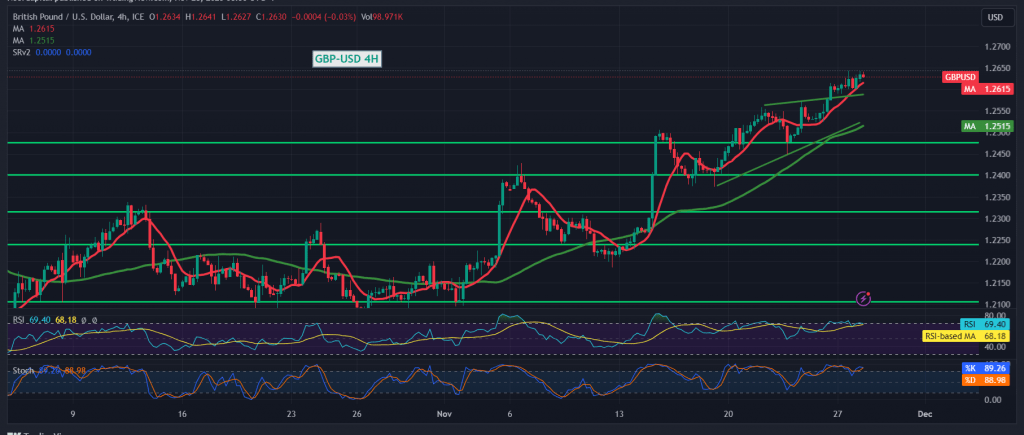

The British pound continued its upward trajectory against the US dollar, achieving the initial target at 1.2640 and reaching a peak of 1.2644.

From a technical perspective, the outlook remains positive, supported by clear signals of a positive crossover on the Stochastic indicator. This is further reinforced by positive momentum from the 50-day simple moving average.

Given these indicators, the most likely scenario for the day is an upward trend, targeting 1.2700 as the initial objective, with potential gains extending further towards 1.2730.

It’s important to note that a sustained move below 1.2590, confirmed by at least an hour candle closing below this level, could delay the prospects of further upside but wouldn’t necessarily negate them. In this case, a retest of 1.2530 might occur, followed by renewed attempts at an upward move. Traders are advised to remain vigilant and monitor key support and resistance levels.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations