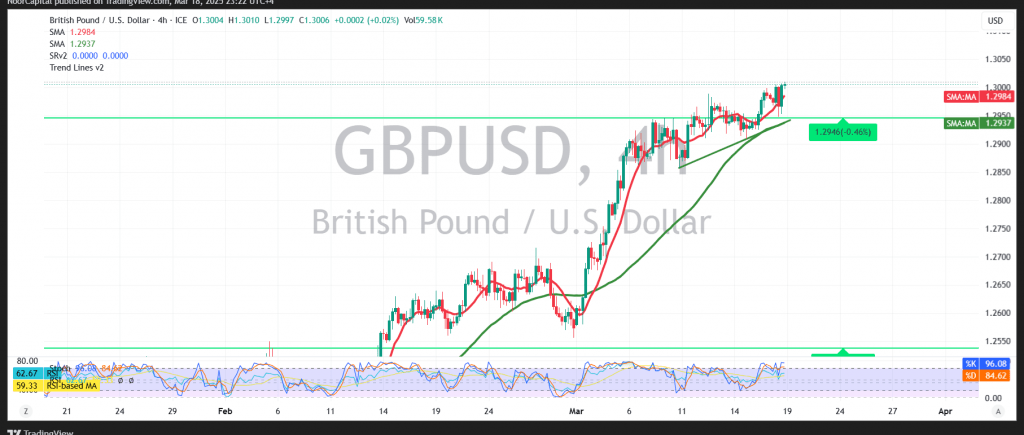

The British pound maintained its bullish trajectory against the U.S. dollar, aligning with the expected scenario in the latest technical analysis. The pair reached its official target of 1.3000, registering a high of 1.3010.

From a technical perspective, the 4-hour chart shows that after experiencing some limited selling pressure in the previous session, the pair regained upward momentum. This renewed strength may support the continuation of the uptrend.

Further gains could be seen if the pair successfully breaches 1.3010, with potential upside targets at 1.3040 and 1.3060. A sustained break above 1.3065 would reinforce the bullish outlook, paving the way toward 1.3110.

On the downside, a return to stable trading below 1.2955 could introduce temporary negative pressure, prompting a retest of 1.2895.

Market volatility is expected to be high today due to key U.S. economic events, including the Federal Interest Rate Decision, Federal Reserve Statement, Federal Reserve Chairman’s Press Conference, and the Federal Reserve Economic Outlook. These factors could significantly influence currency movements.

Given ongoing trade tensions and economic uncertainty, risks remain elevated, and multiple scenarios are possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations