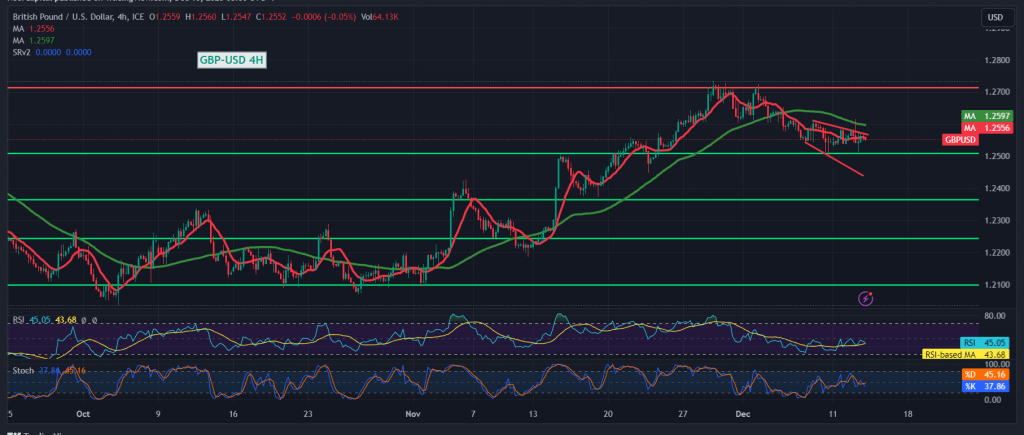

The British pound successfully reached the previously targeted bearish level at 1.2510, hitting a low of 1.2515.

From a technical standpoint today, our trading sentiment tends towards negativity, predicated on the stability of intraday trading below the resistance level of the psychological barrier at 1.2600, particularly emphasizing 1.2620. The pair attempted to retest this level in the prior session but failed to breach it, amidst sustained negative pressure from the 50-day simple moving average.

Consequently, the potential for a resurgence of the downward bias remains valid and effective. A breach below 1.2550 is poised to facilitate a move towards the initial target at 1.2510, followed by 1.2460.

On the upside, the consolidation of prices above 1.2620 would promptly halt the bearish scenario, ushering in a positive trading session with targets at 1.2650 and 1.2690, respectively.

Two warnings accompany this analysis: Firstly, today brings the anticipation of high-impact economic data from the US, including inflation numbers via the “Producer Price Index,” a Federal Reserve Committee statement, a Federal Reserve press conference, interest rate decisions, and economic forecasts. This may lead to significant price fluctuations at the time of the news release. Secondly, trading in CFDs involves risks, and all scenarios presented are illustrative readings of price movements on the chart rather than recommendations to buy or sell. Exercise caution and prudent risk management in trading decisions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations