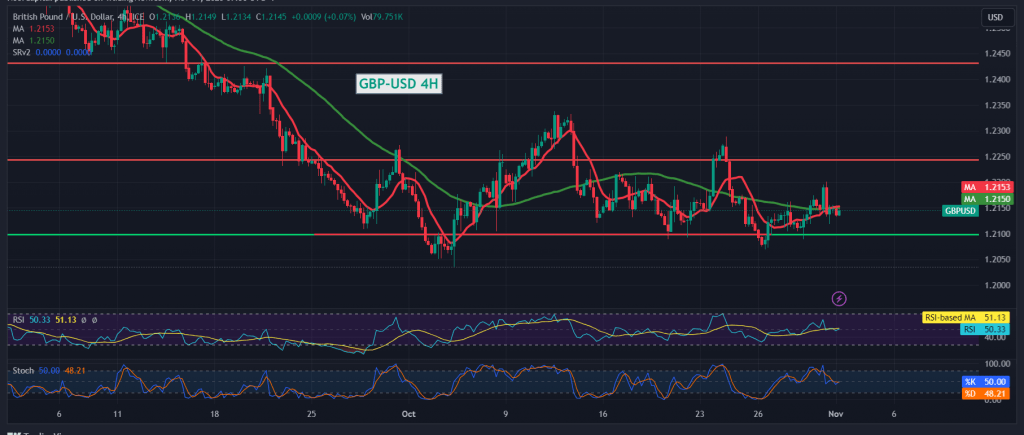

For the second consecutive session, the British pound struggled to breach the extended resistance level at 1.2200/1.2185, maintaining a negative influence on the pair’s movements.

From a technical perspective today, the pair continues its gradual decline within a bearish context, sustaining a negative stance below 1.2185. This negative stability is reinforced by the return of the simple moving averages, exerting pressure on the price from above. Additionally, clear negative signals from the Stochastic indicator further contribute to the bearish sentiment.

Hence, the potential for continued decline remains, particularly if the pair slips below 1.2110, making the journey to 1.2075 more feasible. A breach of this level would intensify the downward pressure, setting the stage for a possible touch at 1.2030, unless there is a notable shift above 1.2185.

It’s important to note that a sustained hourly candle closing above 1.2185 would invalidate the bearish scenario. In such a scenario, the pair could initiate a recovery, aiming for levels around 1.2220 and 1.2270, respectively.

A word of caution: Today, we anticipate the release of high-impact economic data from the American economy, including changes in jobs in the private non-agricultural sector, the ISM manufacturing purchasing managers’ index, the Federal Reserve Committee statement, interest rates, and the press conference of the Federal Reserve chairman. Expect significant market volatility upon the release of this news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations