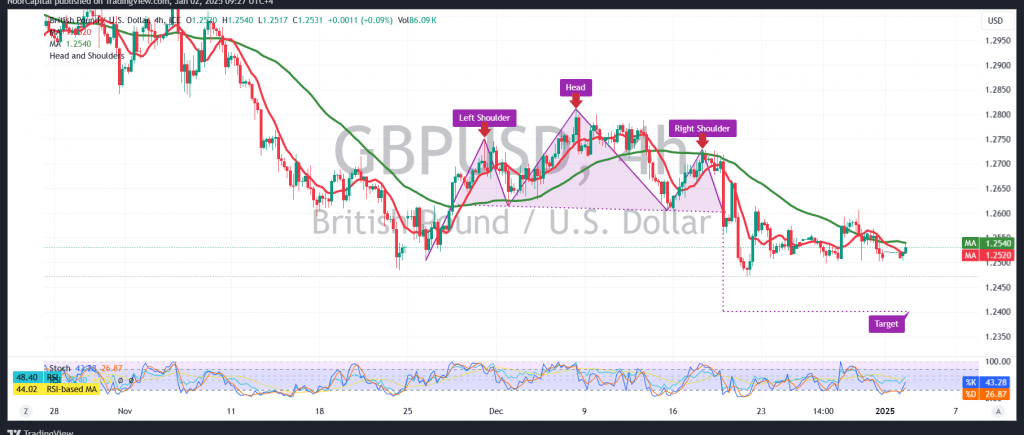

The British pound showed upward attempts against the US dollar, but the pair faced strong resistance around 1.2565, which it has yet to break successfully.

Technical Overview:

Currently, the pair remains unable to breach the critical resistance level of 1.2600, with the Stochastic indicator still signaling bearish momentum, supported by the price’s stability below the 50-day simple moving average.

As a result, the likelihood of a bearish trend in today’s session remains valid. The initial downside target is set at 1.2500, with a break below this level likely to intensify the bearish momentum, paving the way for further declines toward 1.2475 and 1.2440. Extended losses could push the pair toward 1.2400.

Alternative Scenario:

A confirmed break and sustained trading above 1.2600 would invalidate the bearish outlook. In this scenario, the pair would resume its upward trajectory, targeting 1.2650 and 1.2700 as the next levels.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations