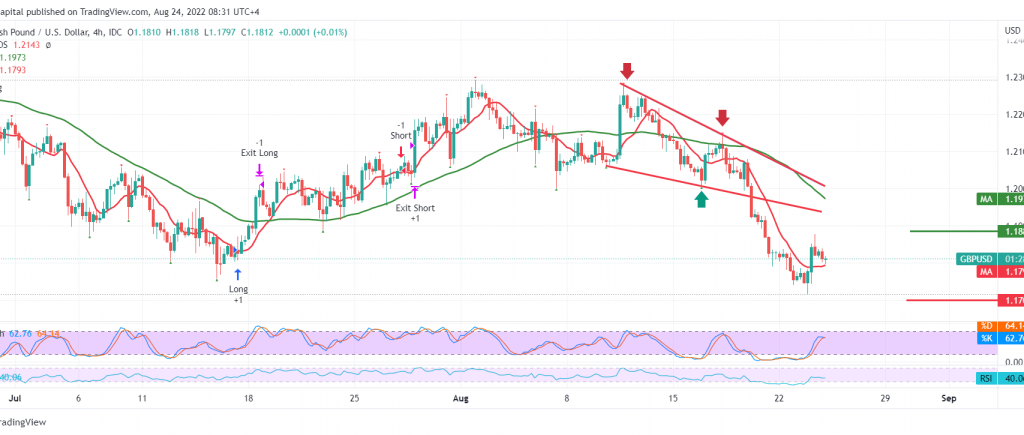

The British pound witnessed limited positive attempts, and the positivity is still weak; as we explained during the last analysis, the attempts to stabilize the pair above 1.1830 can postpone the bearish scenario and lead the pair to recover temporarily to retest 1.1880 to touch the breach target, recording the highest 1.1778.

Technically, the pair hit the resistance level of 1.1880, which forced it to trade negatively again. However, with a closer look at the 4-hour chart, we find Stochastic still providing negative signals that support the continuation of the bearish trend, the stability of the intraday trading below the resistance mentioned above, and the decline of the bullish momentum on short time frames.

We target 1.1770, knowing that declining below it constitutes a negative pressure factor that opens the door for the pound to visit 1.1730, and losses may extend later towards 1.1645 as long as the price is stable below 1.1885.

The return of trading stability and price stability above 1.1885 will stop the daily bearish trend during today’s session, and we will witness reaching the levels of 1.1920 and 1.1960.

Note: The preliminary reading of the services PMI is due to be released today, and we may witness price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations