The pound sterling initiated the week with a robust upward trend against the US dollar, making strides towards challenging the pivotal resistance level situated at 1.2720. The currency achieved its highest level at 1.2730 in early weekly trading.

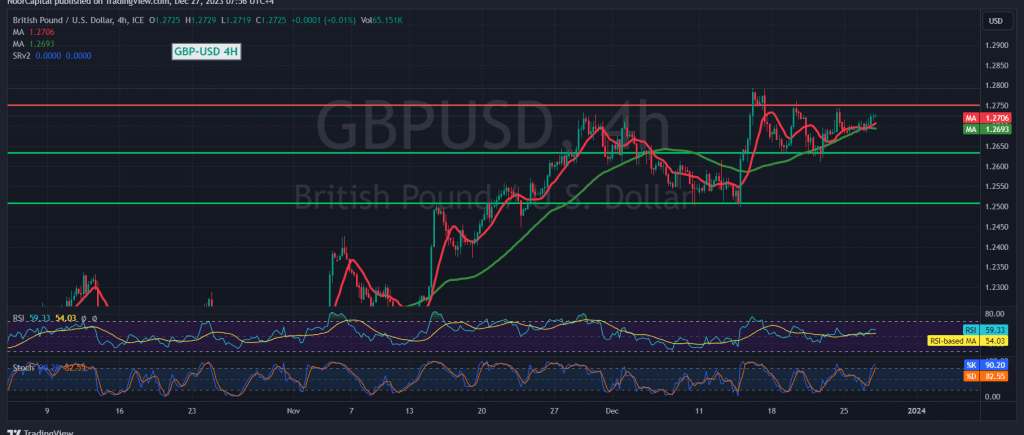

Technical Analysis Overview: Analyzing the 240-minute time frame chart reveals continued support from simple moving averages, bolstering the pound’s position against the US dollar. The Stochastic indicator, currently displaying some negativity, requires a reversal to generate additional momentum, facilitating further upward movement.

Intraday Outlook: Sustaining intraday trading above 1.2690 enhances the probability of a continued ascent, with the initial target set at 1.2750. Notably, breaching the 1.2750 level acts as a catalyst, increasing the likelihood of reaching subsequent targets at 1.2800 and 1.2830.

Risk Considerations: Monitoring the stability of trading above 1.2690 is crucial for the proposed scenario. Any retracement below this level, confirmed by the closure of at least an hourly candle, would disrupt the current trajectory. In such a case, the pair may revisit support levels at 1.2650 and 1.2630 before potential upward attempts.

Risk Warning: The overall risk level is deemed high, and traders are advised to exercise caution. Market dynamics may experience fluctuations, and it’s essential to stay vigilant to potential developments that could impact the pound-dollar exchange rate.

Conclusion: The pound sterling displays a positive momentum against the US dollar, with technical indicators supporting an upward trajectory. Traders should closely monitor the key levels, particularly the resistance at 1.2720 and support at 1.2690, as these will play a crucial role in determining the currency pair’s near-term direction. Prudent risk management remains paramount in navigating the evolving market conditions.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations