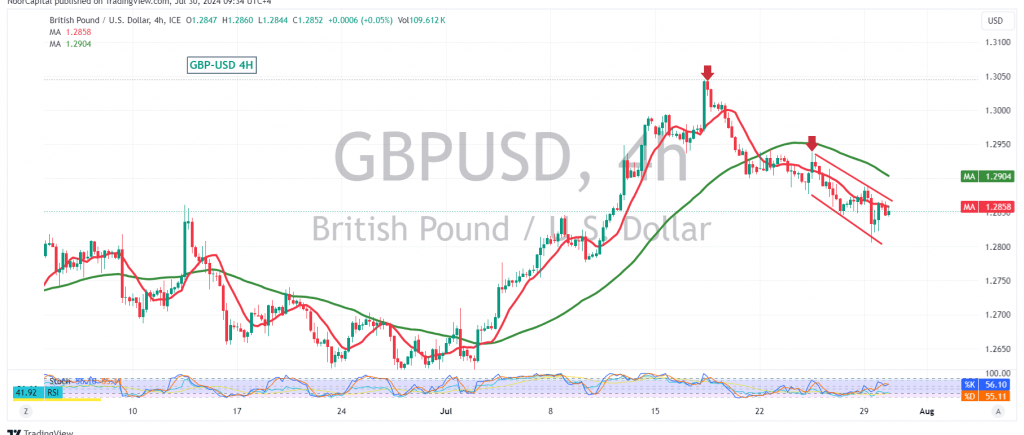

A bearish trend prevailed in the movements of the British pound against the US dollar during the previous trading session, with the pair reaching a low of 1.2807.

From a technical perspective, the 4-hour chart shows that the simple moving averages are exerting downward pressure, reinforcing the daily bearish trend. Additionally, trading remains below the key resistance level of 1.2880.

Given these conditions, there is potential for the downward trend to continue, particularly if we see a clear and decisive break below the support level of 1.2800. This could pave the way for further declines, with targets at 1.2770 and 1.2730.

Overall, we maintain a bearish outlook as long as the pair trades below 1.2880. A break above this resistance level could negate the downward scenario and lead to a retest of 1.2950.

Caution: The release of the “Consumer Confidence” report from the US could trigger significant price volatility. Exercise caution as the risk level may be elevated.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations