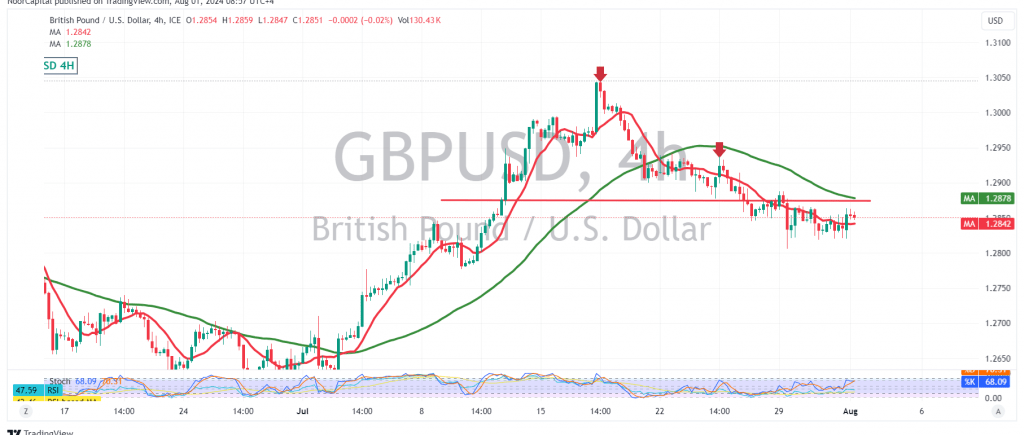

The technical outlook remains unchanged, with the pair continuing to exhibit negative stability below the main resistance level of 1.2880.

On the technical front, the 4-hour chart shows that the simple moving averages are exerting downward pressure, reinforcing the daily bearish price trend. Additionally, trading remains below the key resistance level of 1.2880.

Given these conditions, there is potential for the downward trend to continue, especially if the pair breaks clearly and strongly below the support level of 1.2830. This would pave the way for targets at 1.2770 and possibly further down to 1.2730.

Overall, the bearish outlook remains as long as the pair trades below 1.2880. A break above this resistance level could halt the downward trend and lead to a retest of 1.2950.

Caution: Today’s high-impact economic data releases from the British economy, including the interest rate decision, monetary policy summary, MPC vote on interest rates, and a speech by the Bank of England Governor, as well as US data on unemployment benefits and manufacturing PMI, could cause significant price volatility.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations