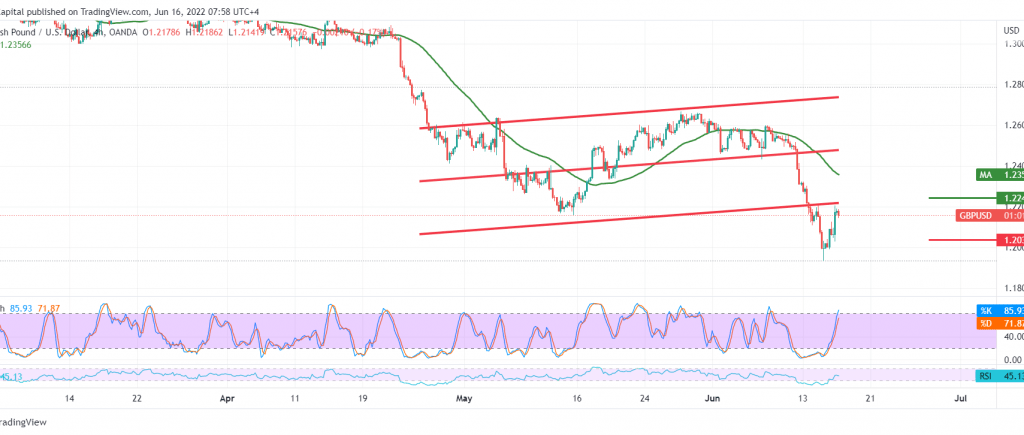

Positive trades dominated the movements of GBP/USD, realizing the idea of the bullish corrective slope required during the previous analysis, touching the retest target of 1.2110, recording a high of 1.2205.

Technically and carefully considering the 4-hour chart, the stochastic is moving around the overbought areas, in addition to moving below the 50-day simple moving average.

Despite the technical factors that support the continuation of the bearish trend, we prefer to monitor the price behaviour of the pair during today’s session, especially as we are waiting for high-impact data from the Bank of England to be facing one of the following scenarios:

Below the 1.2035 level, the pair may witness a resumption of the bearish directional movement, with targets starting at 1.1900

Above 1.2245, the pair may recover from visiting the 1.2335 resistance level.

Note: the level of risk is high.

Note: The BoE monetary policy summary is due today, and we may witness price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations