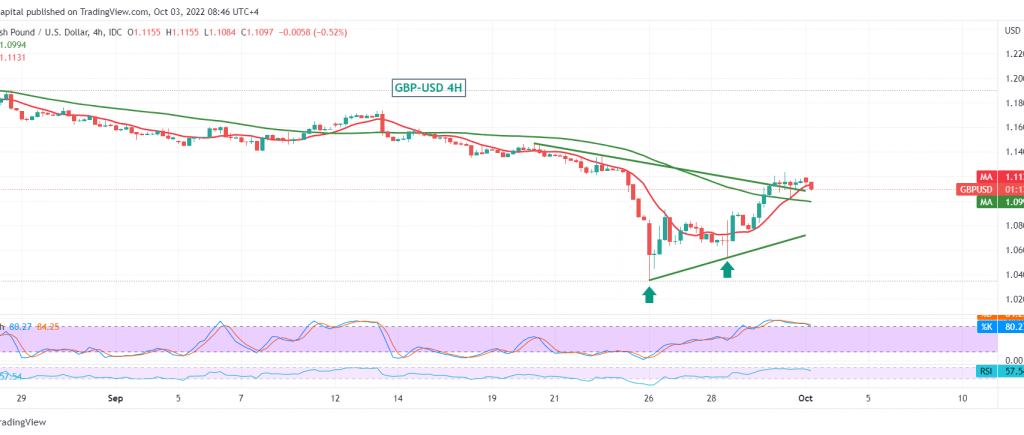

The pound sterling continues to attempt to compensate for losses against the US dollar, recording its highest level at the end of last week’s trading at 1.1235.

Technically, the intraday movements are witnessing the return of price stability below 1.1100, and with a careful look at the 4-hour chart, we notice a strong resistance level near 1.1180, which constitutes an obstacle to the pair, the 50-day simple moving average is trying to support the rise, but the clear overbought signs On the stochastic indicator, which is motivated by the negative signals of the 14-day momentum indicator, announcing that we tend to have a bearish bias in the coming hours, to retest 1.1000 before attempts to rise again.

It should be noted that stability above 1.1180 leads the pair to continue the bullish correction, with targets starting at 1.1210 and extending towards 1.1330.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations