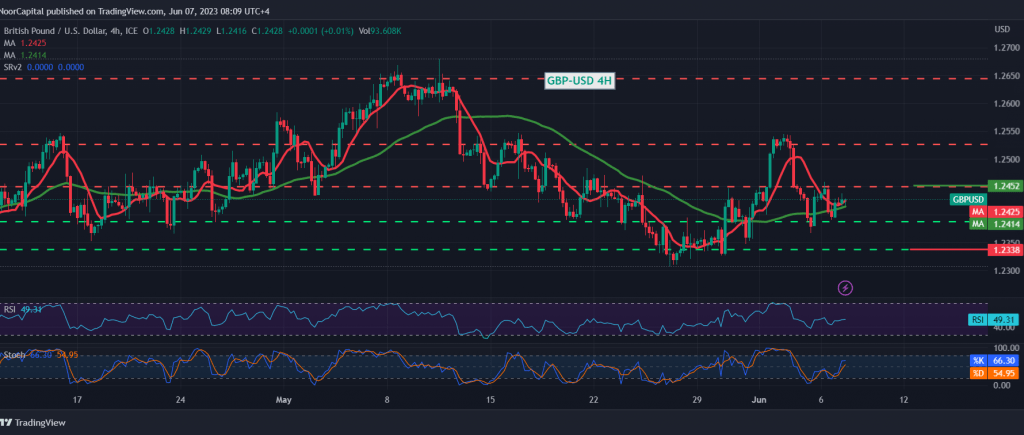

A gradual decline for the pound sterling against the US dollar within the expected bearish technical context during the previous analysis, approaching by a few points at the required target of 1.2380, recording its lowest level at 1.2390, to witness the current movements seeing a limited upward rebound as a result of touching the support level of 1.2390.

On the technical side today, we tend towards negativity in our trading, relying on the entry of the stochastic indicator around the overbought areas to start losing bullish momentum, in addition to the decline in momentum, as evident on the 14-day momentum indicator.

From here, with steady daily trading below the pivotal resistance level of 1.2470, the bearish direction remains the most preferred, targeting 1.2380 as the first target, knowing that breaking it will facilitate the task required to visit 1.2340, the official waiting station.

We remind you that crossing to the upside and consolidating above 1.2470 will immediately stop attempts to retreat, and we await a touch at 1.2510 and 1.2550, respectively.

Note: the 50-day SMA tries to provide temporary positive signals.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations