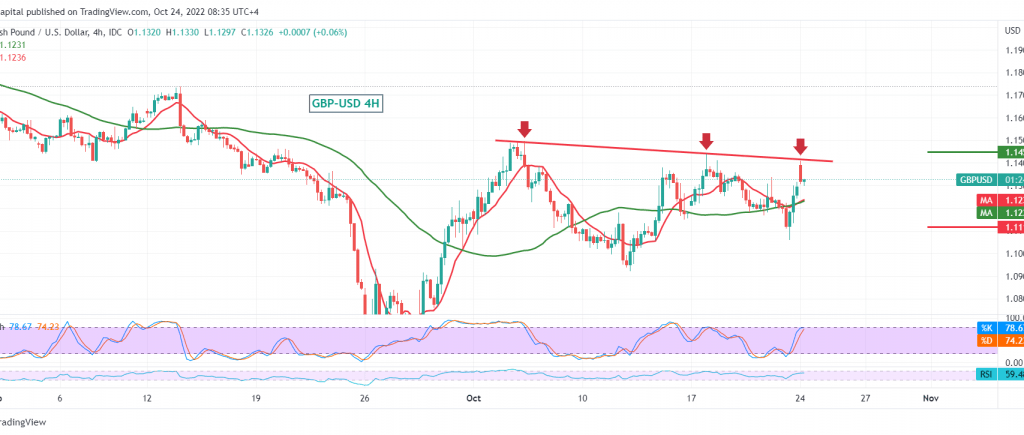

During the last analysis, the British pound presented positive trades against its American counterpart within the expected bullish path, attacking the psychological barrier level of 1.1400 under the influence of some economic news.

Today’s technical outlook indicates the possibility of returning to the bearish scenario after opening the week’s trading on a bullish price gap that is likely to be covered during the day, in addition to the clear negative signs on the stochastic indicator on the 240-minute time frame.

Therefore, the bearish bias may be the most likely in the coming hours, targeting a retest of 1.1120. However, the negative targets may extend later to visit 1.1060 if the price is stable below 1.1380 and, most importantly 1.1400.

Consolidation above 1.1400 will immediately stop the bearish scenario and lead the pair to achieve gains that start at 1.1465 and extend towards 1.1530.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1120 | R1: 1.1465 |

| S2: 1.0910 | R2: 1.1610 |

| S3: 1.0770 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations