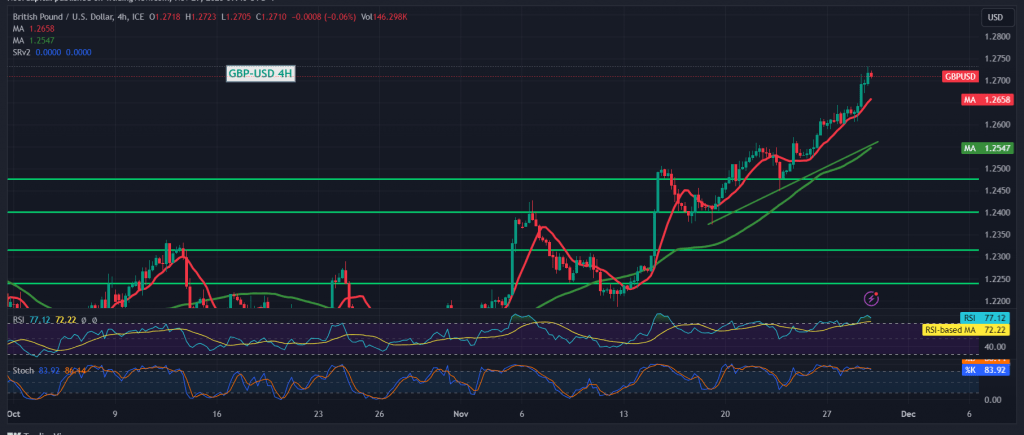

The British pound demonstrated significant positive movement against the US dollar in the previous trading session, aligning with the anticipated upward trajectory and reaching the official target of 1.2730, with the highest recorded level at 1.2733.

From a technical standpoint, our inclination is towards positivity, supported by the continued provision of positive incentives from the simple moving averages and the confirmed breach of 1.2635.

As such, the most probable scenario for the day is an upward trend. However, a critical condition is the consolidation of prices above 1.2730. This consolidation acts as a motivating factor that enhances the likelihood of an ascent towards initial targets at 1.2760 and 1.2810, with the potential for further gains extending to 1.2870.

If the price manages to stabilize below 1.2630 for at least an hour, it would delay the prospects of an upward movement temporarily but would not nullify them. In such a scenario, a retest of 1.2560 might occur before renewed attempts to rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations