An upward trend dominated the British pound’s movements against the US dollar during the previous trading session, reaching the first target of 1.3410 and recording a peak of 1.3434.

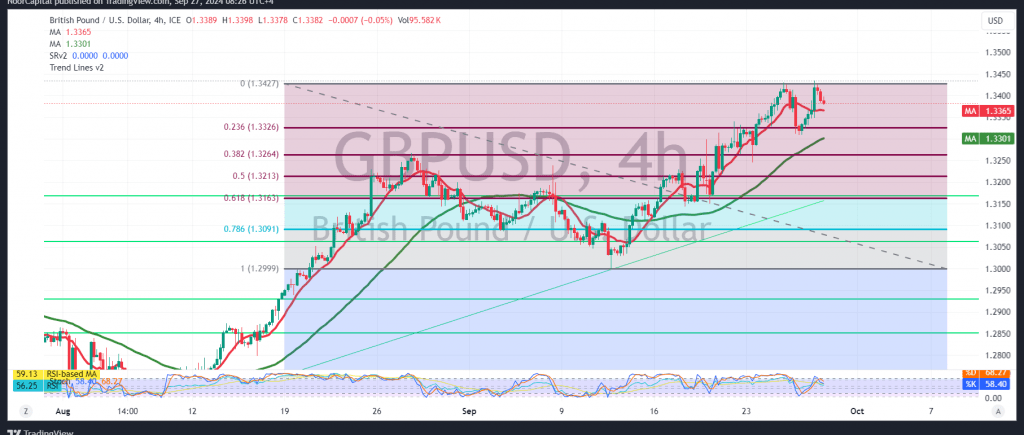

From a technical perspective today, and by closely examining the 4-hour chart, we observe temporary negative pressure due to intraday trading remaining below the psychological barrier resistance of 1.3400. However, the pair is still stable above the 50-day simple moving average, with the Stochastic indicator attempting to eliminate the current negativity.

Therefore, there is a possibility for the upward trend to continue in the coming hours, with the target of 1.3440 still in play. A break above this level would extend gains, opening the path toward 1.3495 in the short term.

We remind you that a return to stable trading below 1.3300 would lead the pair into a downward corrective path, with initial targets starting at 1.3255.

Warning: Today, we are awaiting high-impact economic data from the US economy, specifically “Core Personal Consumption Expenditure Prices – Annual,” which may cause significant price volatility upon release.

Warning: The level of risk is high amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations