The technical outlook remains unchanged, and the movements of the pound sterling against the US dollar did not change, trying to maintain positive stability.

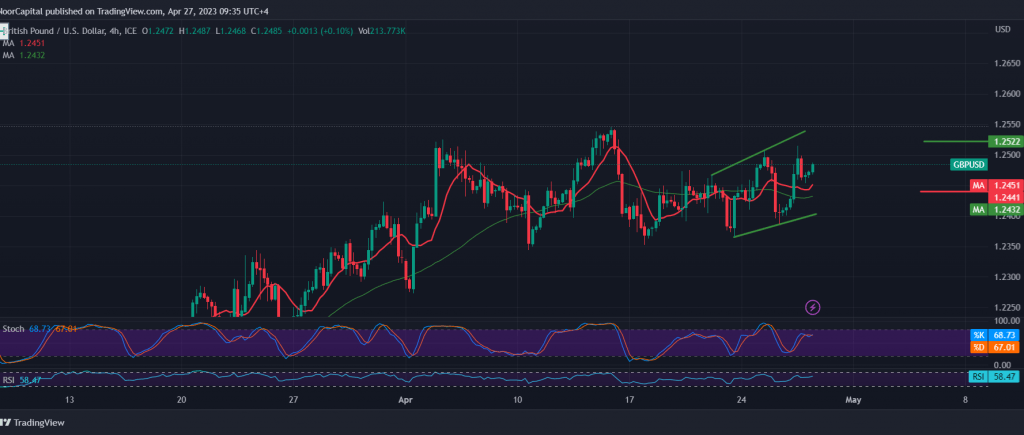

On the technical side today, by looking at the 240-minute chart, we find that the pair is trying to consolidate above the support level of 1.2440, as we find that the stochastic indicator started to gain positive momentum that might push the pair to rise.

We tend to be positive and be cautious, targeting 1.2500, knowing that breaching it is a catalyst that increases the possibility of touching 1.2565 as a next stop.

It should be carefully noted that trading above 1.2440 is a condition for maintaining positive stability, and breaking it will immediately stop the suggested scenario, and we will witness a negative trading session with the target of 1.2370 before it attempts to rise again.

Note: Today we are awaiting high-impact economic data issued by the US economy, “the estimated reading of the gross domestic product,” and we may witness price fluctuations at the time of the news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations