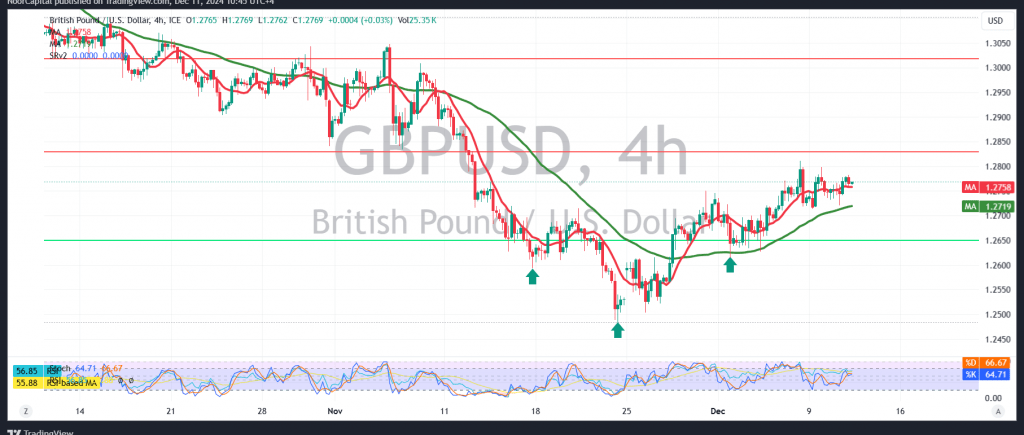

The British pound exhibited bullish attempts against the US dollar, momentarily breaking the 1.2730 The technical outlook for GBP/USD remains consistent, with no significant changes in movement, sustaining the expected bullish trend.

Technical Analysis:

On the 4-hour chart, a bullish technical structure supports a cautious positive outlook, further reinforced by the pair trading above the 50-day simple moving average.

- Bullish Scenario: Trading stability above 1.2730, and particularly 1.2710, upholds the bullish forecast. Immediate targets include 1.2785 and 1.2845. A breach above 1.2845 would likely intensify the bullish momentum, clearing the path toward 1.2865.

- Bearish Scenario: Stable trading below 1.2710 would negate the bullish scenario, reverting the pair to a bearish trajectory with targets at 1.2670 and subsequently 1.2630.

Key Events:

U.S. economic data, specifically the “Annual Consumer Price Index” and “Monthly Consumer Price Index,” is due today. These high-impact releases could lead to significant price volatility.

Warnings:

Exercise caution due to the potential for high market fluctuations during U.S. economic announcements.

The risk level remains elevated amid geopolitical tensions, and unexpected scenarios could arise.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations