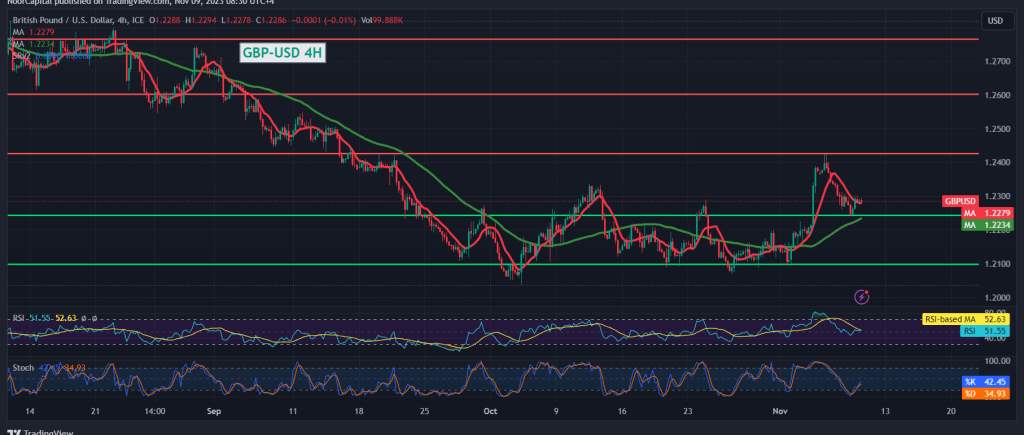

During the previous trading session, the British pound displayed evident negativity against the US dollar, aligning with the anticipated bearish trajectory and nearing the initial target of 1.2245. It reached its lowest point at 1.2240.

In today’s technical analysis, the Stochastic indicator is issuing negative signals, in conjunction with clear downward indications on the 14-day momentum indicator. Additionally, the pound remains below the psychological barrier of 1.2300.

Hence, a bearish bias is likely, with targets set at 1.2245 and subsequently 1.2210 as the immediate support level. Further declines could extend to 1.2170. However, if the price consolidates above 1.2330, this could disrupt the bearish scenario, paving the way for a potential recovery towards 1.2375 and eventually 1.2450.

Warning: Today, we await significant press talks, including “Federal Reserve Governor Jerome Powell’s speech” and “European Central Bank Governor Christina Lagarde’s address,” which might lead to substantial price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations