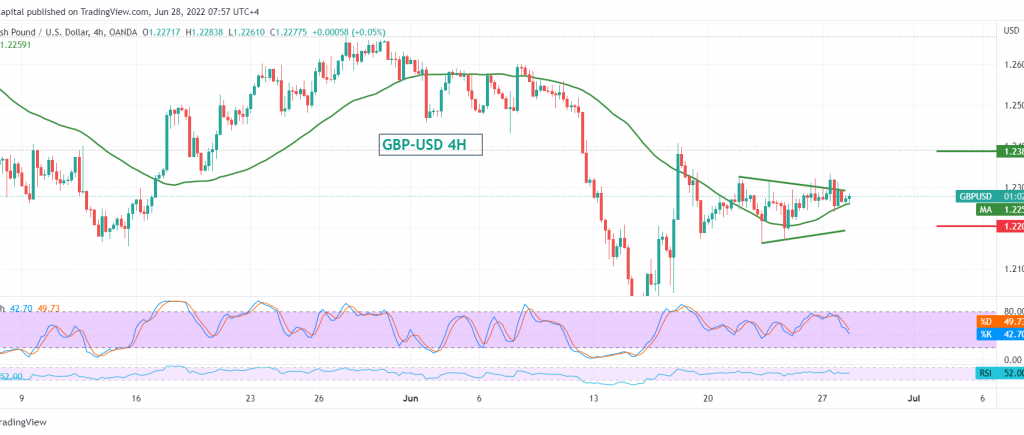

The British pound reached the first target published during the previous analysis, at 1.2325, recording its highest level during the first trading sessions of this week at 1.2332.

Technically, the current movements of the pair are witnessing a slight bearish tendency as a result of hitting the resistance level of the psychological barrier 1.2300, in addition to the clear negative signs on stochastic that may force the pair to present a bearish slope before rising again.

With intraday trading stabilizing above the 50-day moving average, in addition to the pair’s foundation above the main support floor at 1.2200, this makes the bullish scenario the most preferred, knowing that the official targets are around 1.2380 and 1.2425 once 1.2330 is breached.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations