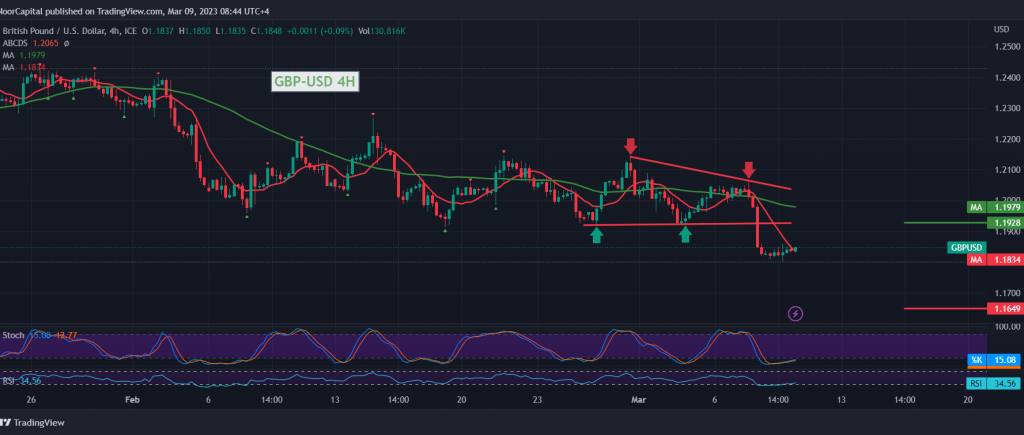

The British pound continues its negative trading against the US dollar, maintaining the bearish context within the beginning of the appearance of a bearish technical formation on the 4-hour time frame.

On the technical side today, by looking at the 4-hour chart, we find that the simple moving averages pressured the price from above, accompanied by the pair continuing to obtain negative signals from the RSI, stable below the midline 50, stimulated by the clear bullish momentum loss on the stochastic.

Therefore, continuing the decline is still valid, knowing that the decline below 1.1800 facilitates the task required to visit 1.1730 as a first target, and losses occurred later towards 1.1640, as long as trading remains stable bekiw the resistance of the psychological barrier 1.1930.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations