Mixed movements dominated the movements of the pound sterling against the US dollar to be able to approach a few points from the official required target of 1.2500, recording its lowest level at 1.2512.

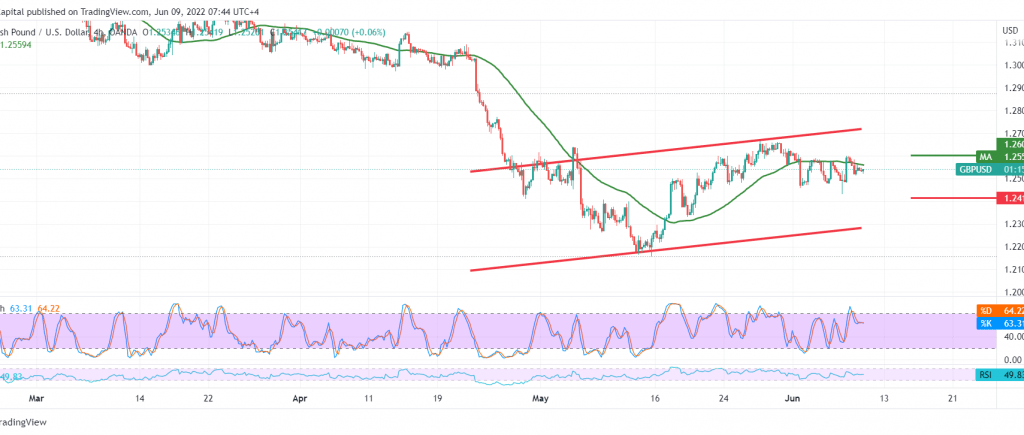

Technically, and carefully looking at the 4-hour chart, we notice the continuation of the movement below the 50-day moving average and the apparent negative features on the momentum indicator.

From here, steadily trading below 1.2570, and most importantly below 1.2600, the bearish scenario remains the most likely today, provided that we witness a break of 1.2500, and that extends the pair’s losses, opening the door to enter a strong descending wave, its initial target is located around 1.2465, while its official target is around 1.2410.

Consolidating above the resistance of the psychological barrier, 1.2600 can thwart the suggested scenario and lead the pair to recover, with the initial target of 1.2635 and 1.2675.

Note: ECB monetary policy statement and press conference are due today and may cause some volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations