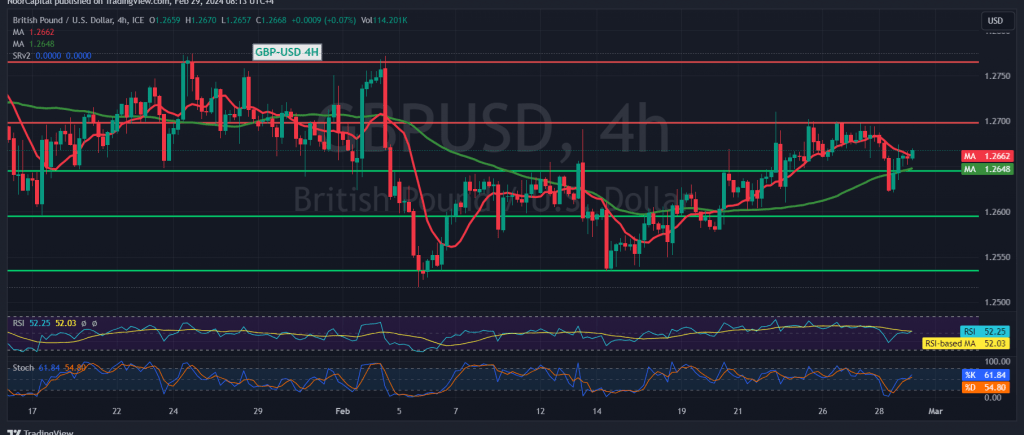

Amidst mixed trading sentiments that veered towards negativity during yesterday’s session, the pound sterling against the US dollar adhered to the anticipated bearish context, achieving the first official target at $1.2600, with a low of $1.2595.

Today’s technical analysis, scrutinizing the 4-hour timeframe chart, reveals a return to stability above the $1.2600 support level, with the pair currently hovering around $1.2665. Notably, the pair maintains stability above the 50-day simple moving average, which converges near $1.2600, reinforcing its significance. Additionally, the 14-day momentum indicator endeavors to generate positive signals.

Despite indications suggesting a potential uptick, we maintain a cautious stance and await a decisive break or penetration of key levels. Specifically, breaching $1.2600 would subject the price to negative pressure, targeting $1.2565 initially. Conversely, surpassing $1.2700 would facilitate an upward trajectory towards $1.2730 and $1.2760.

A word of caution: Today’s trading activity may experience heightened volatility due to the impending release of high-impact economic data from the American economy, including the annual and monthly basic personal consumption spending prices, along with the weekly unemployment benefits. Therefore, traders should remain vigilant during the news release.

By staying attuned to critical levels and potential reversal scenarios, traders can navigate the fluctuations within the pound sterling-US dollar pair with heightened precision and confidence.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations