The British pound achieved noticeable gains against the US dollar within the expected upward trend, touching the second target at 1.2295, recording its highest level of 1.2305.

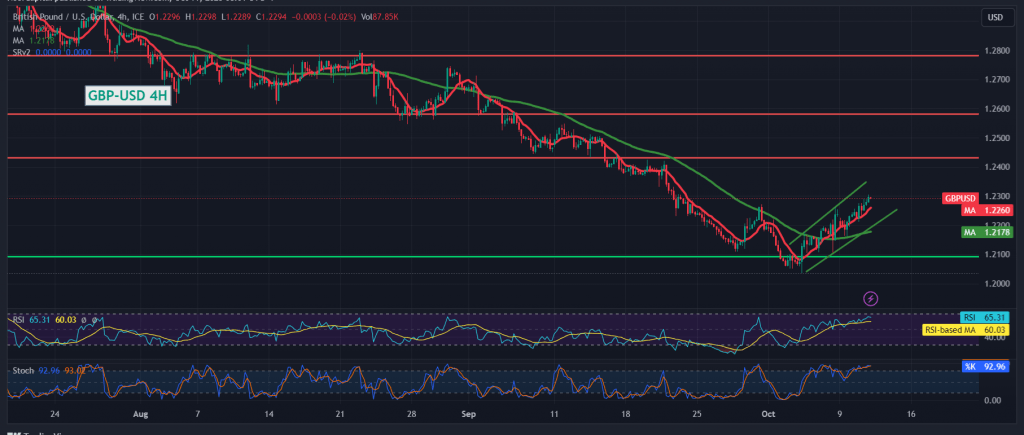

On the technical side today, by looking at the 4-hour time frame chart, the pair continues to receive a positive stimulus from the 50-day simple moving average, which coincides with the continuation of positive signals on the 14-day momentum indicator.

There may be a possibility to continue the rise with confirmation of the pair breaching the psychological barrier resistance level of 1.2300. This motivating factor enhances the chances of touching 1.2330, the first target, and then 1.2360, respectively, noting that trading stability above 1.2235 is a condition for activating the proposed scenario.

Below 1.2235 and closing an hour candle below it postpones the chances of a rise, but does not cancel them, and we may witness a retest of 1.2140 before rising again.

Note: Stochastic is around overbought areas and we may witness some fluctuation until we obtain the desired direction.

Note: Today we are awaiting high-impact economic data issued by the American economy, Producer Price Index and Results of the Federal Reserve Committee Meeting, and we may witness high volatility when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations