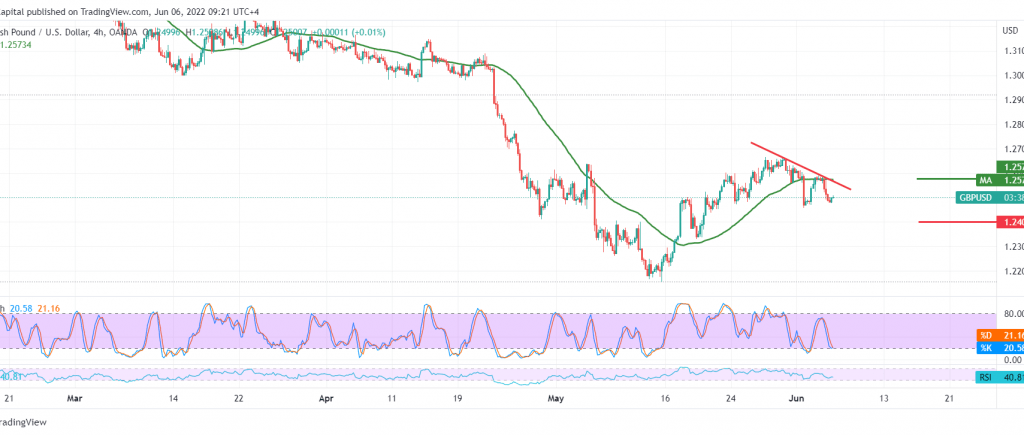

Negative trading dominates the movements of the pound sterling, as we expected, approaching by a few points from the official target published during the previous analysis at 1.2470, recording its lowest level at 1.2476.

On the technical side, we are inclined to the negativity today, relying on the negative pressure of the 50-day SMA, which constitutes an obstacle for the pair, in addition to the bearish technical structure that started forming on the 4-hour time frame.

Therefore, the bearish scenario may be the most likely today, targeting 1.2450/1.2460, taking into consideration that breaking the mentioned level leads the pair to enter a strong descending wave that begins with its targets around 1.2400 and may extend later to visit 1.2350 as long as the price is stable below 1.2580.

Consolidation above 1.2590 is able to thwart the bearish trend, and the pair recovers with an initial target of 1.2635.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations