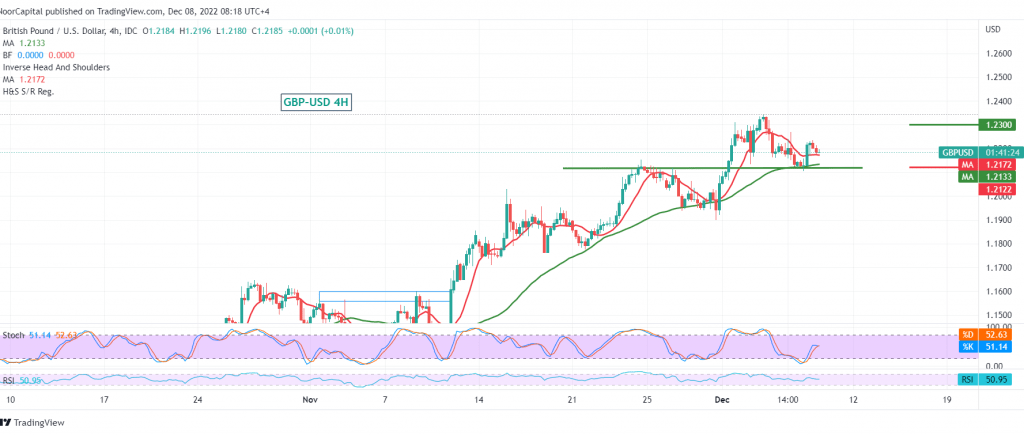

The pound sterling touched the bearish target that was required to be touched during the previous analysis, at 1.2100, to return to the bullish rebound as a result of touching the support level of 1.2100, represented by the target, to record its highest level at 1.2235.

On the technical side today, we tend to be positive, relying on the stability of intraday trading above the support floor of 1.2160, which is accompanied by the positive impulse of the 50-day simple moving average, in addition to Stochastic’s attempts to get rid of the current negativity.

Therefore, the bullish bias may be the most likely during the day, targeting 1.2245 as the first target, noting that its breach increases and accelerates the strength of the bullish daily trend, so we will be waiting to touch 1.2305 unless we witness any trading below 1.2120.

A decline below 1.2120 completely invalidates the activation of the bullish scenario and puts the price under negative pressure, targeting 1.2050/1.2070.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations