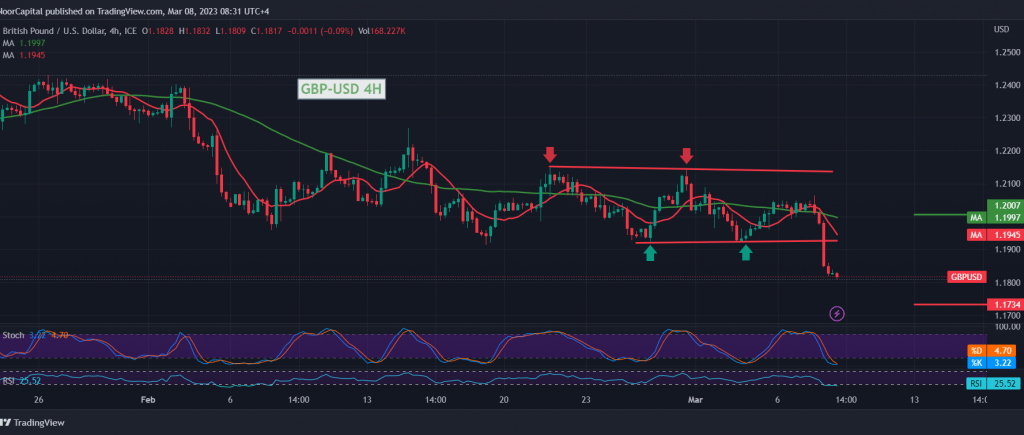

The British pound witnessed intense selling operations due to the rise of its American counterpart to confirm its breach of the 1.1930 support floor, explaining that breaking the mentioned level would immediately stop the suggested bullish scenario and put the pair under negative pressure, with an initial target of 1.1930. As a result, it may extend later towards 1.1870, recording its lowest level during the early trading of the current session at 1.1810.

On the technical side today, by looking at the 4-hour chart, we find that the simple moving averages pressed clearly on the price from above, accompanied by the continuation of the pair obtaining negative signals from the relative strength index, stable below the mid-line 50.

Therefore, continuing the decline is still valid and effective, knowing that the decline below 1.1800 facilitates the task required to visit 1.1730 as a first target, and losses may extend later towards 1.1640 as long as trading remains stable below the resistance of the psychological barrier 1.2000.

Note: Today, we are awaiting high-impact economic data, and we may witness high volatility in prices, and irregular movements may occur:

- ADP Employment Change

- JOLTS Job Openings in US and Employment Change in Eurozone

- The semi-annual testimony of Jerome Powell, Chairman of the Federal Reserve, before the Senate.

- ECB’s President Lagarde’s speech

- Bank of Canada interest rate decision and statement.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations