The British pound extended its gains against the U.S. dollar in the previous session, breaking above the psychological resistance at 1.3500 and reaching a new high of 1.3590 during early trading.

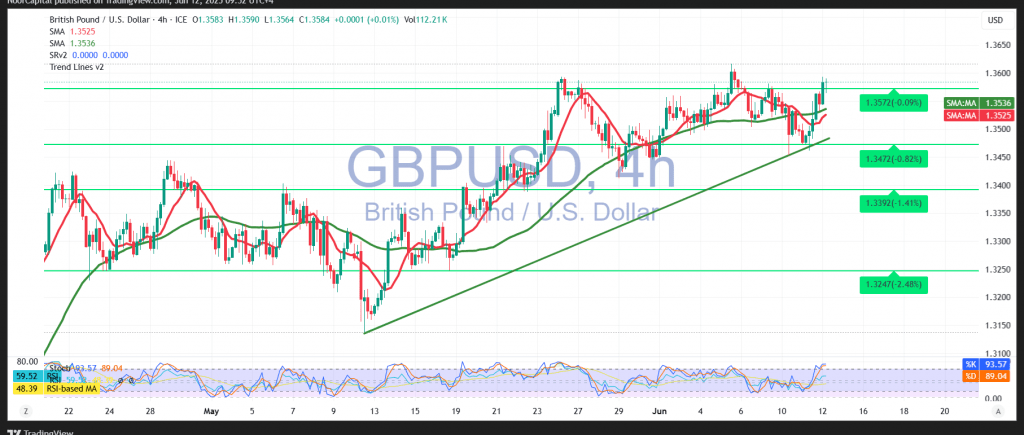

From a technical perspective, the 4-hour chart shows the price stabilizing above the breached 1.3500 level, which now acts as support under the principle of role reversal. This move is reinforced by the positive positioning of the simple moving averages, which continue to serve as dynamic support levels and contribute to the bullish momentum.

With price action holding above 1.3510 and consistent bullish signals from technical indicators, the pair appears poised for further upside. A confirmed break above the key 1.3600 resistance level would likely accelerate the bullish move, opening the way to the first target at 1.3635, followed by 1.3675. A sustained breakout could see gains extend toward the 1.3760 zone.

However, should the pair retreat and stabilize below 1.3510, this could disrupt the current bullish structure and place downward pressure on the pair, with a potential pullback toward the 1.3420 support level.

Warning: Traders should remain cautious ahead of today’s release of the U.S. Core Producer Price Index (PPI), both monthly and yearly. This high-impact data could trigger significant market volatility across USD pairs.

Risk Note: Volatility remains elevated amid global trade uncertainties, and multiple scenarios remain in play.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations