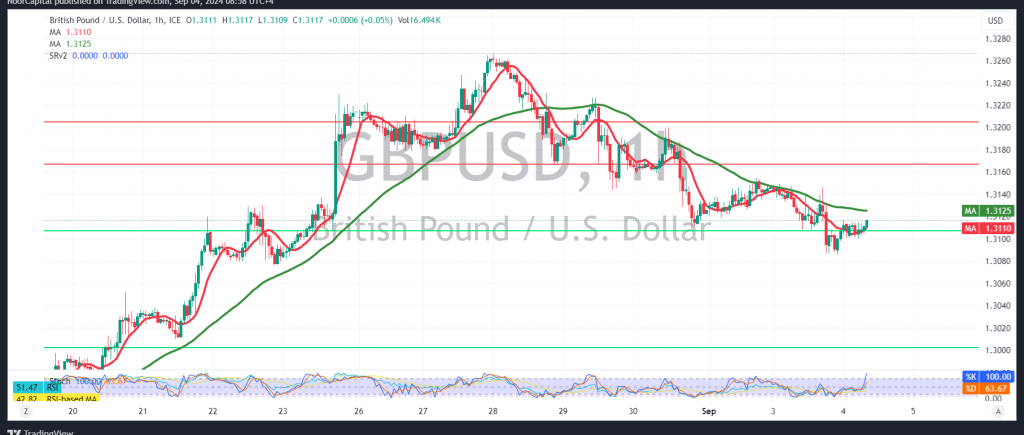

The British pound continued its gradual decline against the U.S. dollar, coming within a few pips of the target mentioned in the previous report at 1.3080, reaching a low of 1.3088.

Technically, the 4-hour chart reveals ongoing negative pressure from the simple moving averages, which supports the daily downward trend. The chart also displays a bearish technical structure.

Given this setup, there is potential for the downward trend to resume in today’s session, with an initial target of 1.3050. If this level is breached, the decline could extend towards 1.3000.

Overall, we maintain a bearish outlook as long as the pair trades below 1.3130. A break above this level would invalidate the bearish scenario, leading to a potential retest of 1.3170, with gains possibly extending towards 1.3200.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations