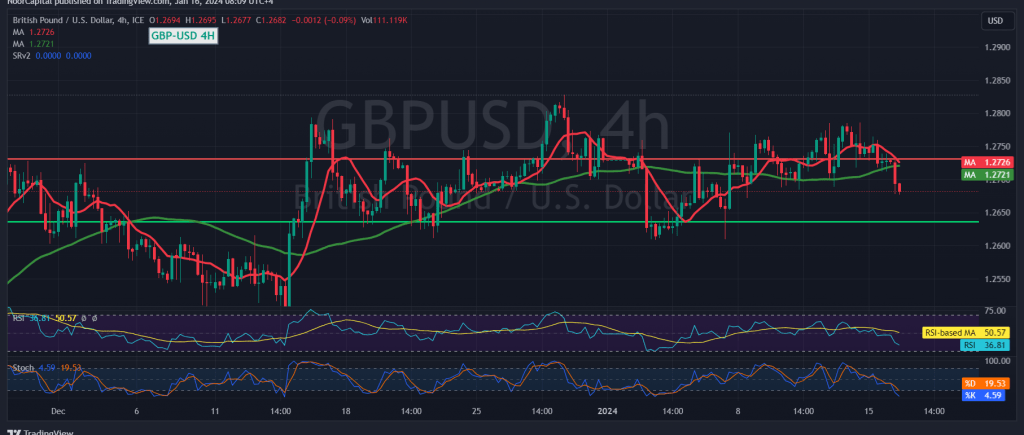

The British pound faced resistance against the US dollar, failing to sustain recent gains as it encountered the 1.2750 resistance level and struggled to consolidate above it.

From a technical standpoint, a negative outlook is favored, given the stability of trading below the robust resistance at 1.2750. This resistance level is exerting continued downward pressure on the pair, complemented by clear negative signals from the relative strength index.

Consequently, the preferred scenario for today’s trading session is a downward trend, with targets at 1.2650 and 1.2620. Breaking the latter level would intensify and accelerate the strength of the downward trend, with 1.2570 as the subsequent station.

On the upside, an upward crossover and consolidation above 1.2750 would negate the anticipated downward trend, guiding the pair to retest 1.2800 and 1.2830.

Caution is advised as high-impact economic data is anticipated today, including the “New York State Manufacturing Index” from the American economy, Canadian inflation data, and key updates from the United Kingdom, such as “the change in unemployment benefits” and a speech from the Governor of the Bank of England. Expect heightened price volatility during the release of these news items.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations