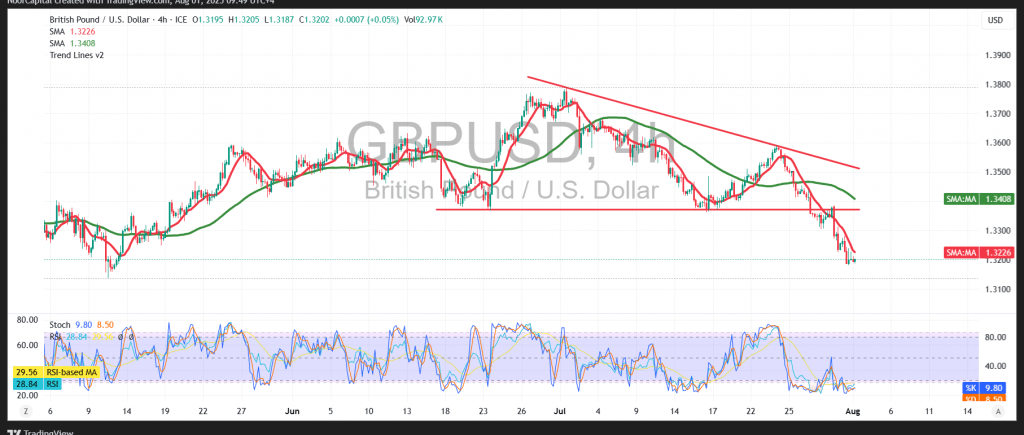

The GBP/USD pair successfully reached the first downside target identified in our previous report at 1.3205, recording a session low of 1.3186.

Technical Outlook:

Intraday price action shows limited rebound attempts, supported by temporary consolidation above the 1.3200 support level. The Relative Strength Index (RSI) has begun to generate early positive signals after entering oversold territory, suggesting potential for a short-term pause in selling.

However, the broader bearish trend remains firmly in place, with the price trading below the 50-period Simple Moving Average (SMA), which continues to serve as a dynamic resistance level. Downside momentum remains dominant.

Likely Scenario:

As long as the pair remains below the critical resistance level at 1.3260, the bearish outlook is favored. A confirmed break below 1.3200 would likely reinforce downward momentum, opening the door for declines toward 1.3165, followed by 1.3125 as a secondary support level.

Alternative Scenario:

A successful breakout above 1.3260 and sustained trading above this level could signal the beginning of a recovery wave, with upside targets at 1.3320 and 1.3360, respectively.

Key Risk Events – Volatility Expected:

Traders should prepare for sharp price swings as markets await the release of major U.S. economic indicators today, including:

- Non-Farm Payrolls

- Unemployment Rate

- Average Hourly Earnings

These releases are likely to impact U.S. dollar strength and increase GBP/USD volatility.

Warning:

Risk remains elevated amid global trade tensions and geopolitical uncertainty. All scenarios are possible, and appropriate risk management is strongly advised.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations