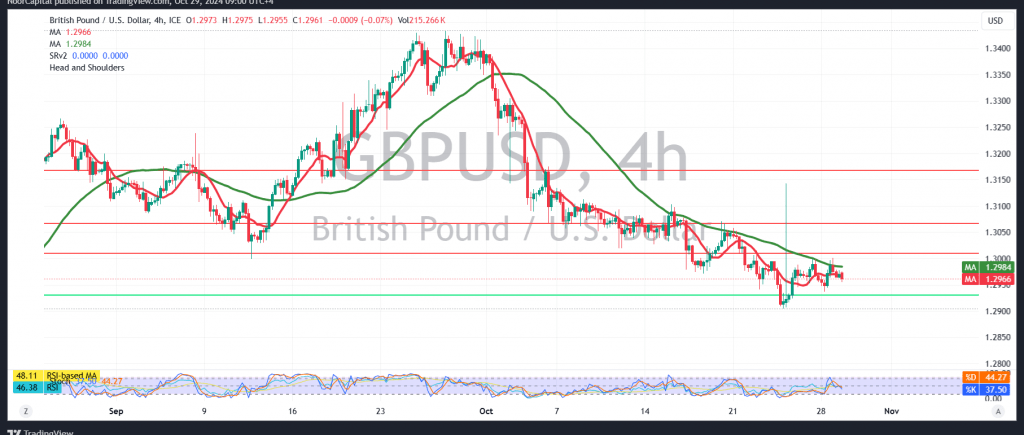

The British pound has struggled to maintain its position above the psychological resistance level of 1.3000, resulting in negative trading and a decline to its lowest level of 1.2940.

Technical Analysis:

- The outlook for the downtrend remains valid, given that the price continues to trade below 1.3000 and the 50-day simple moving average.

- We expect the downward movement to target 1.2930, and if the price dips below this level, it could extend losses towards initial targets of 1.2865.

- Should the pair manage to consolidate above 1.3000 and close an hourly candle above this level, it may indicate a potential upward trend, aiming for a retest of 1.3040.

Warnings:

- High-impact economic data from the US, such as Consumer Confidence, Job Openings, and Labor Turnover, is anticipated today, which could lead to significant price volatility during the news release.

- The overall risk level is high due to ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations