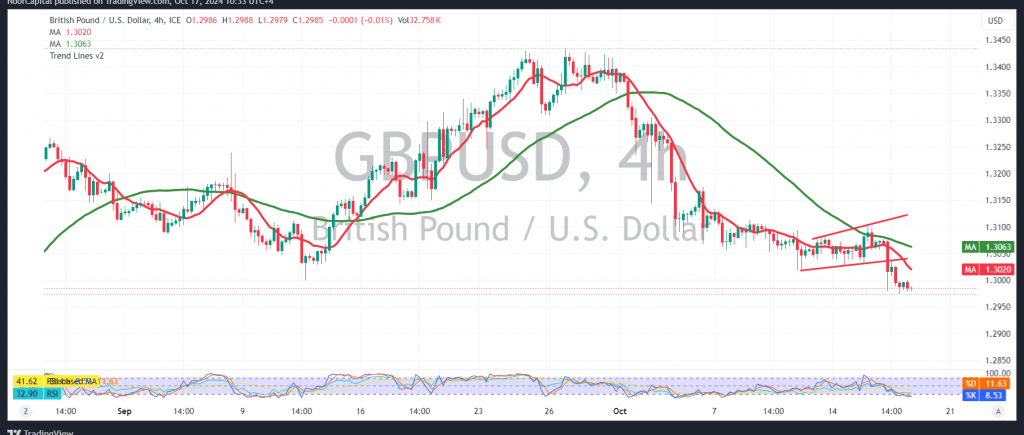

The British pound continues its expected decline against the U.S. dollar, approaching the first target of 1.2955, with its lowest level recorded at 1.2977.

Technical Outlook:

Today’s analysis indicates a bearish bias, supported by the pressure from simple moving averages and the price’s stability below the 1.3000 level, which now acts as resistance. The bearish trend is likely to continue, targeting 1.2955. If the pair breaks below this level, further losses may extend towards 1.2910, with a potential for reaching 1.2870 if 1.2900 is breached, accelerating the downtrend.

However, if the pair successfully holds above 1.3000 and closes an hourly candle above this level, there may be an attempt to reverse the trend, targeting 1.3110 for a potential retest.

Warnings:

- High-impact economic data: The European Central Bank’s decisions on interest rates and a U.S. report on retail sales and unemployment benefits are expected, leading to potential volatility.

- Risk is high: Geopolitical tensions elevate market uncertainty, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations