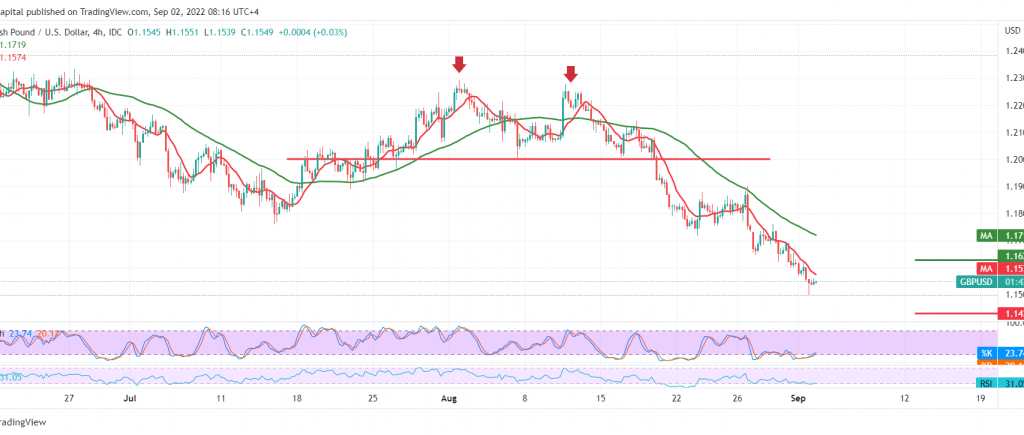

As we expected yesterday, the British pound continued to achieve its losses against its American counterpart within the solid bearish context, touching the official target of 1.1500, and recording its lowest level at 1.1500.

On the technical side, the simple moving averages still constitute a hindrance to the pair, in addition to the stability of the daily trading below the psychological barrier of 1.1600, accompanied by a decline in momentum.

The resumption of the decline is valid and effective, but on the condition that we witness a clear and strong break of the pivotal demand area for the general trend in the short term 1.1500, and breaking it will extend the losses of the current descending wave to target 1.1440 initially. Losses may extend to visit 1.1370 if the price is stable below 1.1610/1.1600.

Consolidating above 1.1610 might push the pair towards retesting 1.1675 initially.

Note: The US NFP, unemployment rate data and average wages are due for release today in the USA, and they have a big impact, and we may see price fluctuations; all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations