Mixed trading dominated the pound sterling against the US dollar, affected by the Bank of England’s decision to raise interest rates. Still, we find the pair maintaining negative stability as we expected.

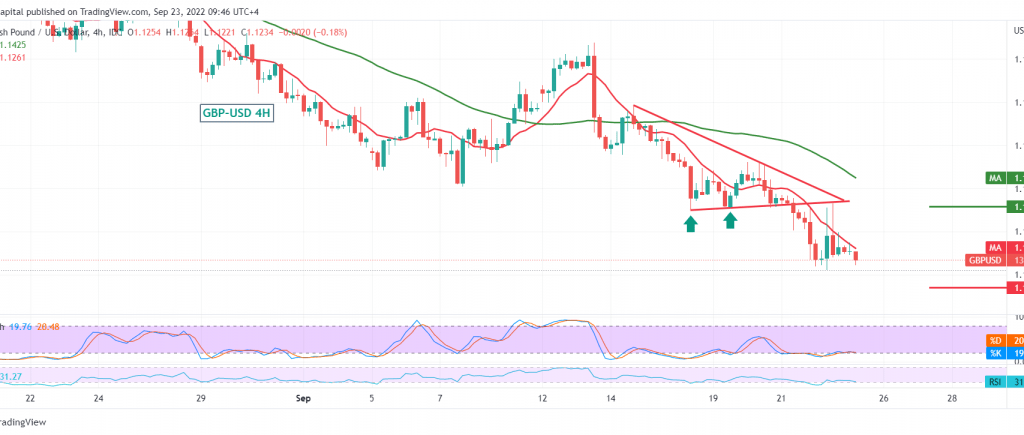

On the technical side, the pair hit a strong resistance level around 1.1350, which forced it to return to the downside path accompanied by the continuation of the negative pressure of the 50-day simple moving average, which comes in conjunction with the clear negative signs on the momentum indicator.

Therefore, the bearish scenario will remain valid and effective, provided that we witness a clear and strong break of the 1.1220 level, which leads the price to visit 1.1175, a first target. The price must be monitored well around 1.1175 because breaking it increases and accelerates the strength of the daily bearish trend, to be waiting to touch the 1.1120 level.

Activating the above-suggested scenario requires daily trading to remain below 1.1350, noting that any attempt to breach 1.1350 will temporarily stop the daily bearish trend, and we will witness an upward corrective slope targeting 1.1450.

Note: We are awaiting the Federal Reserve’s speech later in today’s session and may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations