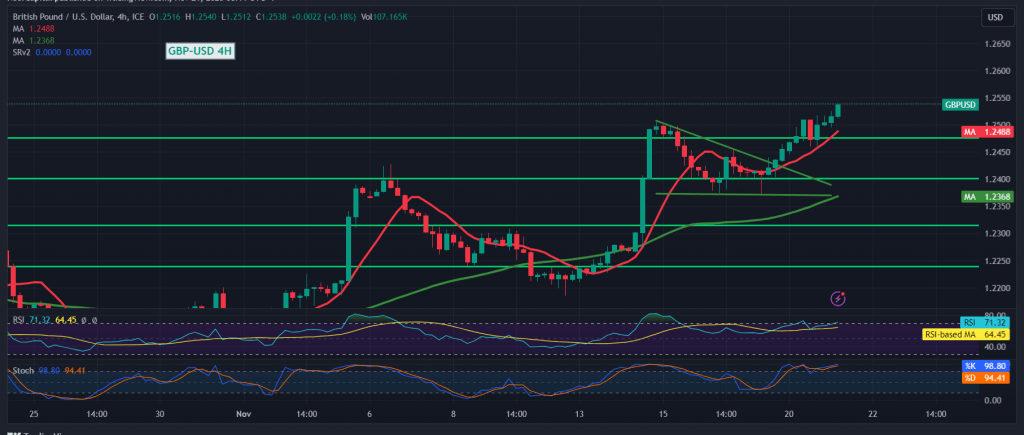

A noticeable surge in the pound sterling against the US dollar, achieving significant gains within the bullish context expected during the previous technical report, surpassing the required official stop at the price of 1.2520, recording its highest level of 1.2540.

On the technical side today, we tend to be positive, relying on the stability of intraday trading above the psychological barrier resistance of 1.2500, and in general above the strong support level of 1.2475, with the continued movement above the 50-day simple moving average, in addition to the positive signals coming from the relative strength index and its stability above the 50 midline.

Therefore, the upward bias is the most aggressive during the day, targeting 1.2570 as the first target, and then 1.2605 as the next target, knowing that the jump upwards and the price consolidation above 1.2605 may enhance the pair’s gains, as we wait for 1.2665.

Closing at least an hour candle below 1.2465 postpones the chances of a rise, but does not cancel them, and we may witness a retest of 1.2410 before attempts to rise again.

Warning: Today we are awaiting high-impact economic data issued by the American economy, “the results of the Federal Reserve Committee meeting” and the press talk of the President of the European Central Bank, “in addition to the consumer price index from Canada, and we may witness high fluctuation in prices.”

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations