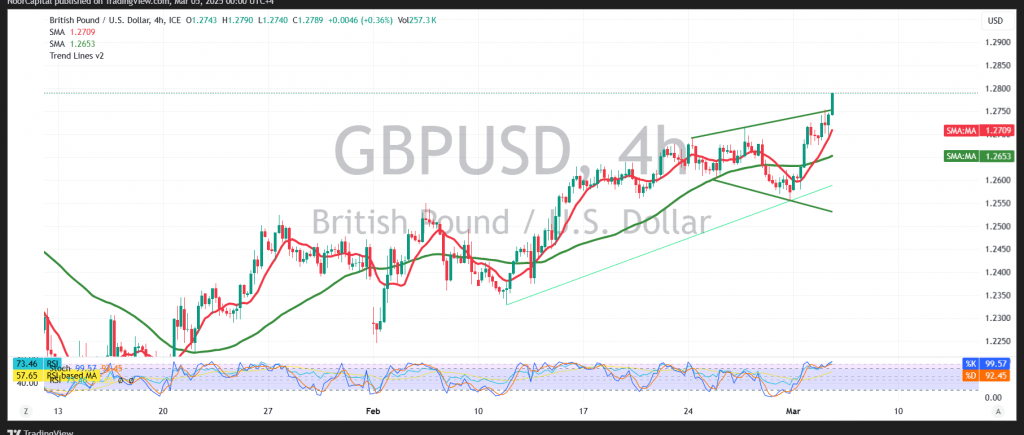

The British pound continued its upward trend against the US dollar, progressing toward the target of 1.2760 from our previous report and reaching a high of 1.2788.

Technical Outlook

- Bullish Indicators:

- The simple moving averages have resumed providing positive momentum, supporting the uptrend.

- The Relative Strength Index (RSI) is showing clear bullish signals.

- The breach of the psychological resistance level at 1.2700—now acting as support—further reinforces the bullish scenario.

- Potential Targets:

- With the current momentum, an upward move toward 1.2825 appears likely as the initial target.

- A break above 1.2825 could further accelerate gains toward 1.2860 and potentially even 1.2920.

- Bearish Contingency:

- Should trading stability and price cohesion fall below 1.2715, the pair may reverse into a corrective downward trend, targeting 1.2645 initially.

Risk Warning

Ongoing trade tensions continue to pose risks, and multiple scenarios remain possible.

Economic Data Impact:

High-impact US economic data, specifically the “non-farm private sector employment data,” is scheduled for release today, which could lead to increased volatility in both prices and news.

Market Uncertainty:

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations