As we expected, the British pound jumped against the US dollar, surpassing the official target mentioned in the previous analysis at 1.1590, recording the highest level at 1.1646.

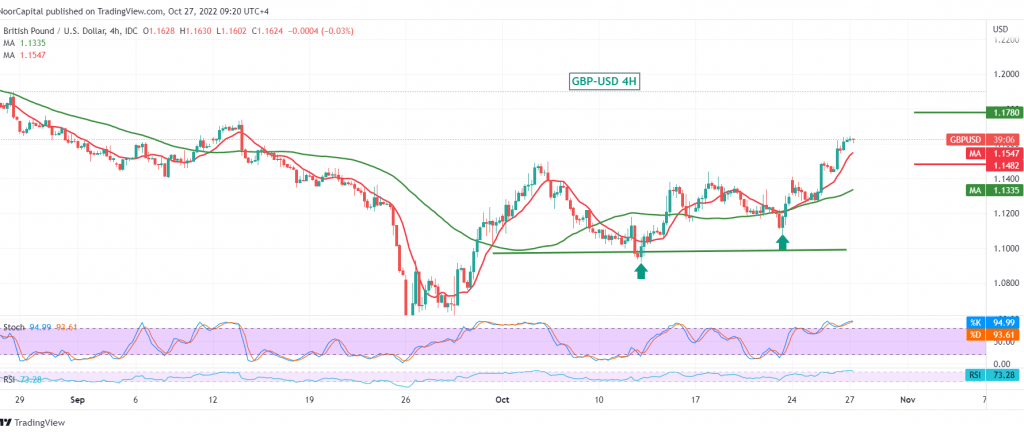

On the technical side today, by looking at the 4-hour chart, we find that the 14-day momentum indicator continues to provide positive signs that enhance the chances of a rise, in addition to the pair getting positive stimulus from the 50-day simple moving average.

Therefore, the continuation of the bullish daily trend is the most likely, targeting 1.1705, a first target, and its breach will extend the gains of the pound against the dollar, so we will be waiting for a visit of 1.1780 to 1.1840.

The return of trading stability again below the psychological barrier 1.1500 support floor negates the activation of the proposed scenario completely and leads the pair towards retesting 1.1400 before attempts to rise again.

Note: The euro rate decision and European Central Bank press conference are due today. They have an important impact, and we may witness high price volatility and erratic movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1490 | R1: 1.1705 |

| S2: 1.1350 | R2: 1.1780 |

| S3: 1.1270 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations