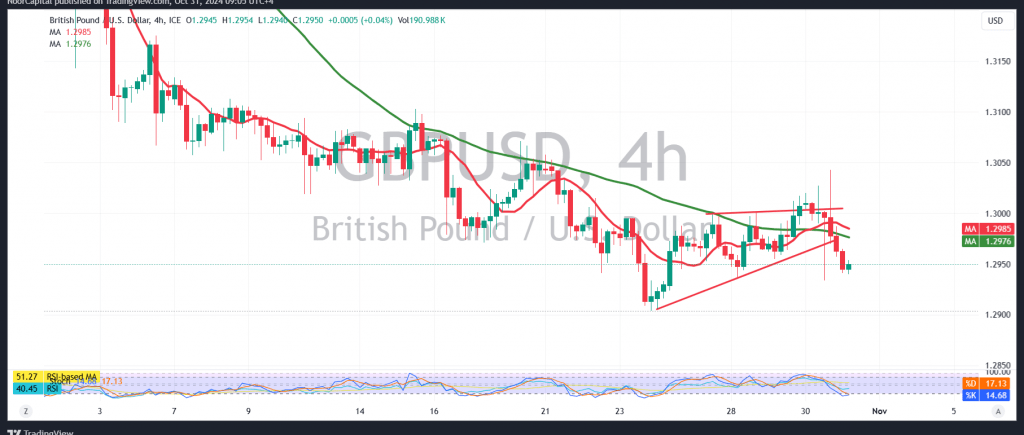

The GBP/USD technical outlook remains steady, with little change following the pair’s struggle to maintain levels above the 1.3000 resistance, leading it to dip to a low of 1.2940.

Technical Analysis:

- Downtrend Potential: With trading still below the 1.3000 psychological resistance and the 50-day SMA, there are ongoing prospects for a downtrend.

- Target Levels: A drop below 1.2900 could deepen losses toward 1.2865, considered the next key level.

- Upside Scenario: Conversely, should the pair consolidate above 1.3000 with a confirmed hourly close, this may trigger a brief upward trend to retest 1.3040.

Warnings:

- Upcoming US economic data (Core PCE Prices, Unemployment Benefits, and the Employment Cost Index) may drive high volatility.

- Risk is elevated due to geopolitical tensions, increasing the likelihood of unpredictable movements across markets.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations