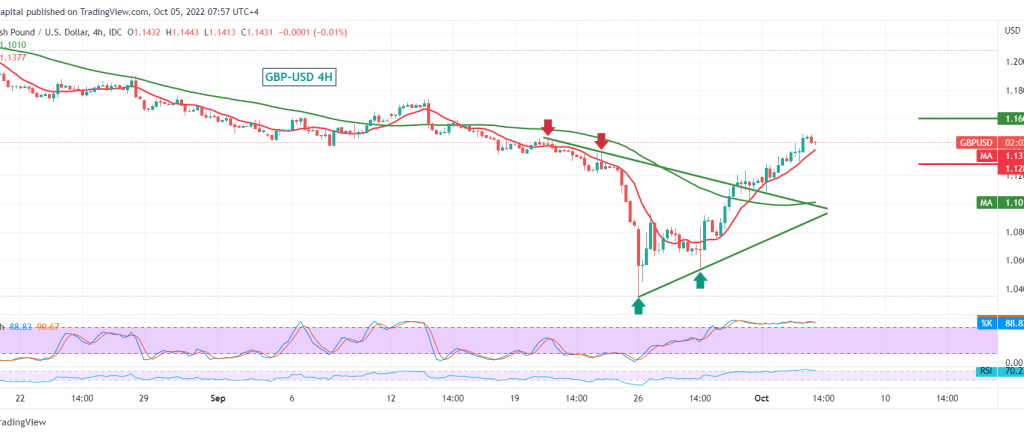

The expected corrective ascent continues to dominate the movements of the pound sterling against the US dollar, touching the first target station yesterday at 1.1410 and approaching by a few points at the second target 1.1500, recording the highest 1.1490.

On the technical side, today, and with careful consideration on the 4-hour chart, we find that the pair succeeded in establishing the second support floor located at 1.1360, and most important its stability above 1.1310, which is accompanied by the positive motive of the simple moving averages that support the occurrence of further progress at the expense of the US dollar.

Therefore, the bullish scenario may be the most likely during today’s session, targeting 1.1525 first target. However, its breach will increase and accelerate the corrective ascent to visit 1.1600, the next awaited station.

We remind you that the activation of the proposed scenario depends on the stability of the pair’s exchange rate above the support floor of 1.1315 and above 1.1280.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations