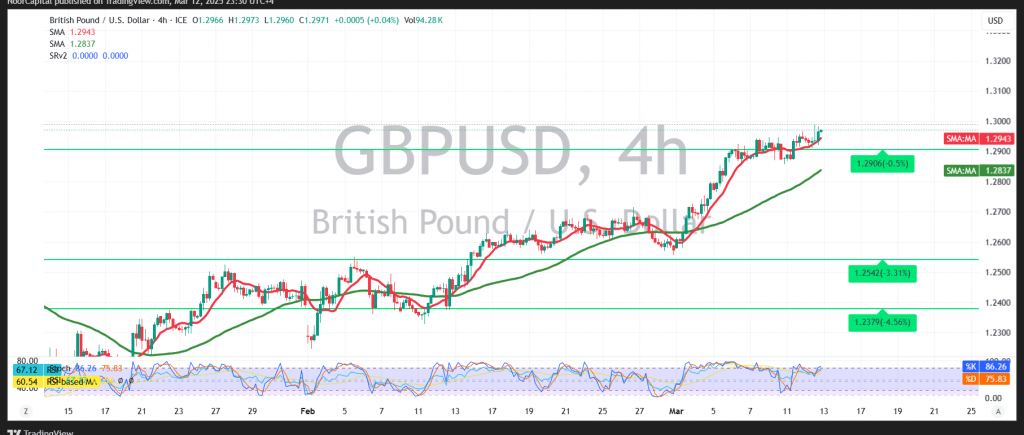

The British pound extended its gains against the U.S. dollar, in line with the positive outlook outlined in the latest report. The pair reached the first target at 1.2975, coming within a few pips of the next resistance at 1.3000, recording a session high of 1.2989.

On the 4-hour chart, the pair remains stable above the psychological barrier of 1.2900, with the 50-day simple moving average (SMA) continuing to provide positive momentum, reinforcing the potential for further upside.

A break above 1.3000 may open the door for further gains toward 1.3015 and 1.3060, respectively. Stability above 1.3060 would accelerate bullish momentum, paving the way for a test of 1.3100.

However, a return to stability below 1.2900 could expose the pair to temporary bearish pressure, leading to a potential retest of 1.2825.

Market Watch & Risk Factors

Risk remains elevated due to ongoing trade tensions, keeping all scenarios on the table.

High-impact U.S. economic data (monthly and annual producer price index reports and weekly jobless claims) are set to be released today, which may drive high volatility in the market.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations