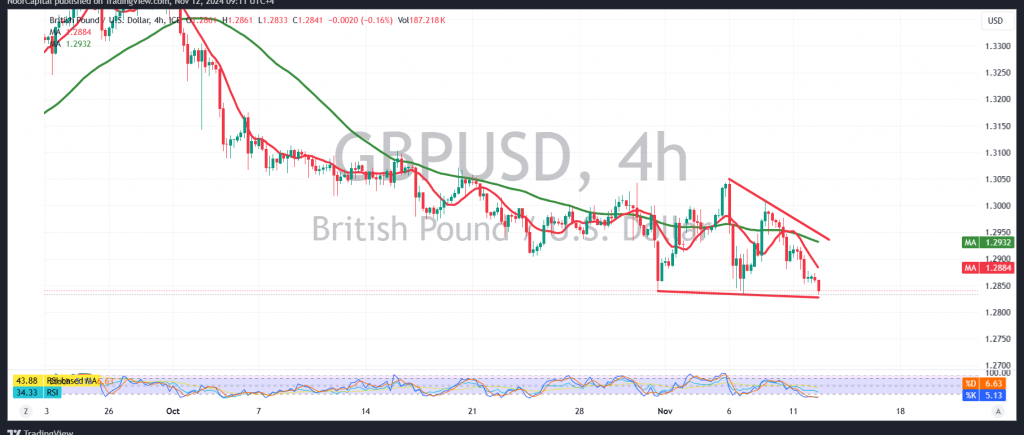

The British pound continues to experience strong negative pressure against the US dollar as the trading week opens. The dollar is exerting pressure on the pound, aligning with the anticipated negative outlook, as the pair gradually moves closer to the target outlined in the previous analysis at 1.2820, with a session low of 1.2836 recorded.

Technical Analysis:

- Bearish Outlook: The downtrend remains likely and active, given that trading stays below the 1.2900 psychological resistance level and the price is below the 50-day simple moving average.

- Targets: We maintain a negative view, aiming for 1.2810 as the initial target. A break below this level could extend the decline, opening the path toward 1.2775 and eventually 1.2730.

- Upside Potential: If the pair consolidates above 1.2900 with an hourly candle close, it could trigger an upward move, initially retesting levels at 1.2960 and 1.2990.

Warnings:

- High Risk: With ongoing geopolitical tensions, the risk level is elevated, and price volatility may increase. All scenarios should be considered with prudent risk management.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations