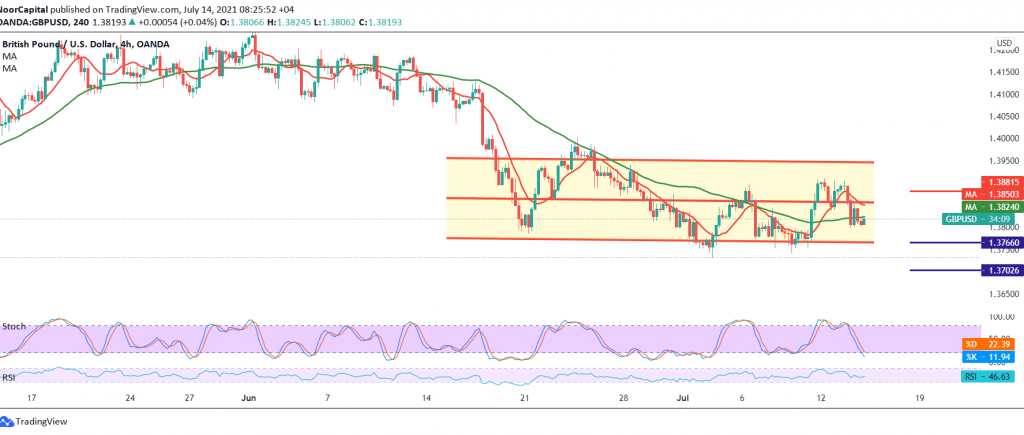

Mixed trading dominated the movements of the pound sterling against the US dollar. After it succeeded in approaching the required target of 1.3920, to record a high at 1.3905, touching the resistance of the psychological barrier 1.3900, pushing the price to retest the pivotal support 1.3810.

Technically, and looking at the 240-minute chart, the moving average started to pressure the price from the upside negatively. We find the negative features that began to appear on the stochastic that gradually started to lose the bullish momentum.

Although we tend to be negative, we prefer to witness a break of 1.3800 to target 1.3775, and then 1.3830/1.3720 an official station in the event of a break. Trading and stabilizing again above the resistance level of 1.3880 can thwart the suggested bearish scenario, and the pair recovers with an initial target of 1.3950.

| S1: 1.3775 | R1: 1.3880 |

| S2: 1.3735 | R2: 1.3950 |

| S3: 1.3670 | R3: 1.3990 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations