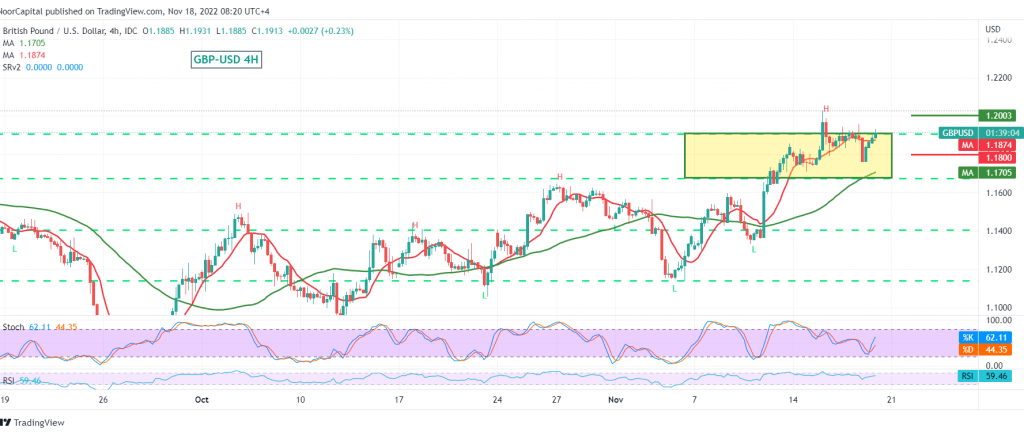

Trading tended to be negative, dominating the movements of GBPUSD within retesting support, recording a low yesterday at 1.1760, to trading within the official bullish path, and witnessing the current movements of the pair stabilizing around its highest level during the morning trading at 1.1920.

On the technical side, the positive support from the 50-day simple moving average stimulates chances of an upside, in addition to the positive signs from the stochastic.

From here, with steady daily trading above 1.1800, the bullish scenario remains the most preferred, targeting 1.2000 as an initial station, knowing that its breach increases and accelerates the strength of the bullish daily trend, paving the way initially for a visit to 1.2080.

The decline below 1.1800 can thwart the suggested bullish scenario completely and put the pair under negative pressure, its initial target is to retest the pivotal support 1.1730, before attempting to rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1800 | R1: 1.2000 |

| S2: 1.1680 | R2: 1.2080 |

| S3: 1.1595 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations