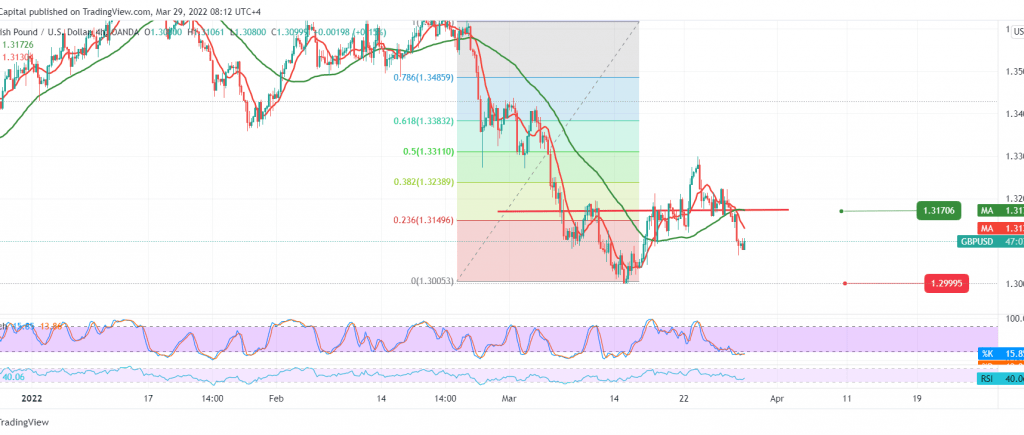

During the previous session, the British pound underwent strong selling within the negative outlook. As a result, we expected to touch the first required target of 1.3110, heading to visit the second target at 1.3095, recording its lowest level at 1.3066.

Technically and carefully considering the 240-minute chart, we find the price is stable below the previously broken support-into-resistance at 1.3170. We also notice the price stability below the 50-day moving average, pressing the price from above.

We need to witness breaking 1.3060 to facilitate the task required to visit 1.3045, and then 1.2995, next target, whose bearish targets may extend later to visit 1.2930 as long as the price is stable below 1.3170, and in general, trading below 1.3240, 38.20% correction, bearish trend.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3045 | R1: 1.3170 |

| S2: 1.2995 | R2: 1.3240 |

| S3: 1.2925 | R3: 1.3285 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations